Overview: a look at the Bank of Canada’s September 2025 rate cut, its impact on the GTA housing market, and what it means for buyers, sellers, and mortgage holders. Our August market report examined the chances of another rate cut in September, putting the odds between 62-70%. It turns out…

Tag: home prices

August 2025 GTA Housing Market: Prices Dive As Buyers Rise

Overview: a look at the August 2025 GTA housing numbers, including home sales, prices and inventory, the potential for future rate cuts, and advice for buyers and sellers. August was a very good month for GTA homebuyers, with prices falling considerably year-over-year. On the other hand, sellers had it rough,…

January 2025 Rate Cut & GTA Housing Market Report

Overview: a look at the Bank of Canada’s (BoC) January 2025 rate cut, plus its impact on GTA home sales, prices, mortgages, buyers and sellers. On January 29th, the Bank of Canada (BoC) slashed interest rates from 3.25% to 3%. The 25 basis point reduction marks the sixth consecutive time…

2024-2025 GTA Housing Market: Review & Forecast

Overview: a look back at 2024 and predictions for the 2025 GTA housing market, including home sales, prices, inventory, interest rates, insured mortgage caps and more. Interest rates dictated whether buyers would return, sellers would list, how much inventory was available, and whether prices would go up or down. When…

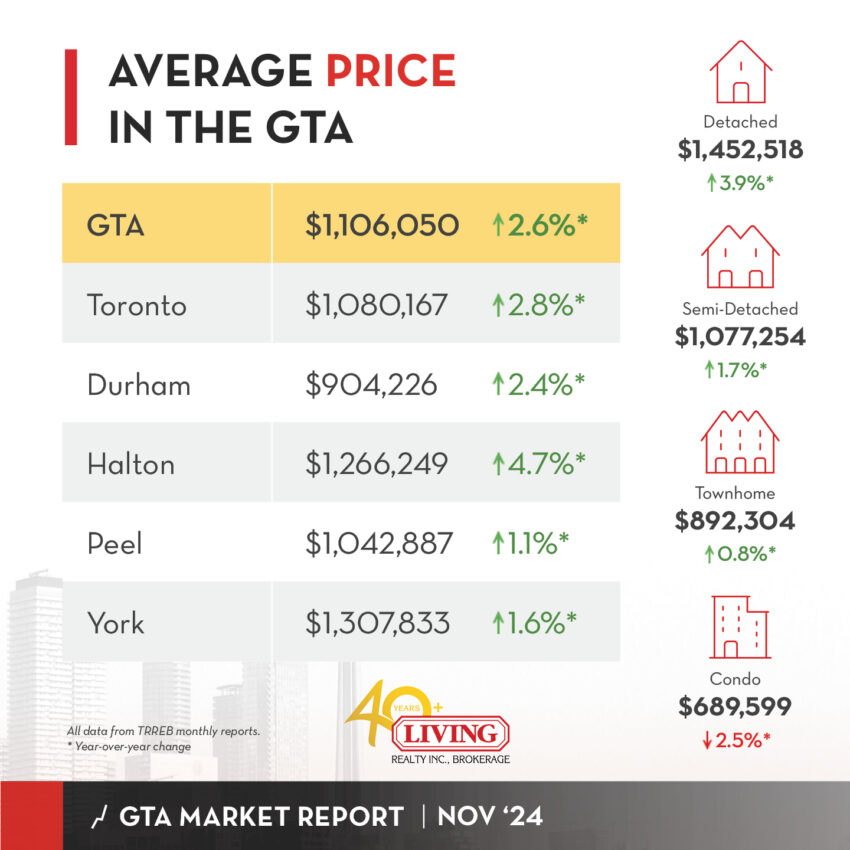

GTA Home Sales, Prices Jump In November 2024 After Rate Cut

Overview: a look at the November 2024 GTA housing market data, including sales, prices and inventory, the impact of the central bank’s most recent rate cut, and advice for home buyers and sellers. Five rate cuts—including two jumbo-sized ones—tend to have that effect. Sales and prices are up, more sellers…