Overview: a look at the August 2025 GTA housing numbers, including home sales, prices and inventory, the potential for future rate cuts, and advice for buyers and sellers.

August was a very good month for GTA homebuyers, with prices falling considerably year-over-year.

On the other hand, sellers had it rough, with their properties attracting fewer buyers, fetching lower prices and remaining on the market longer.

Could another interest rate cut change all that?

And if so, how likely is the Bank of Canada (BoC) to slash rates on September 17th?

Let’s look at the latest housing data, forecast future rate cuts, and explore how buyers and sellers can successfully navigate the market.

August 2025 GTA Housing Market Numbers

Here’s a year-over-year look at the August 2025 numbers:

- GTA Home Prices: down 5.2% to $1,022,143

- Toronto Home Prices: down 3.6% to $992,085

- GTA Home Sales: up 2.3% to 5,211

- Toronto Home Sales: up 3.5% to 1,779

- New Listings: up 9.4% to 14,038

- Active Listings: up 22.4% to 27,495

Despite an uptick in sales, home prices were down across Toronto and the GTA.

The Toronto Regional Real Estate Board (TRREB) explains why:

[Home] buyers benefitted from an even larger increase in the inventory of listings. Average selling prices continued to be negotiated downward due to the elevated choice across market segments.

As sales rose 2.3%, supply increased even faster, with new and active listings surging 9.4% and 22.4% respectively.

The result? Buyers faced less competition and could negotiate lower prices.

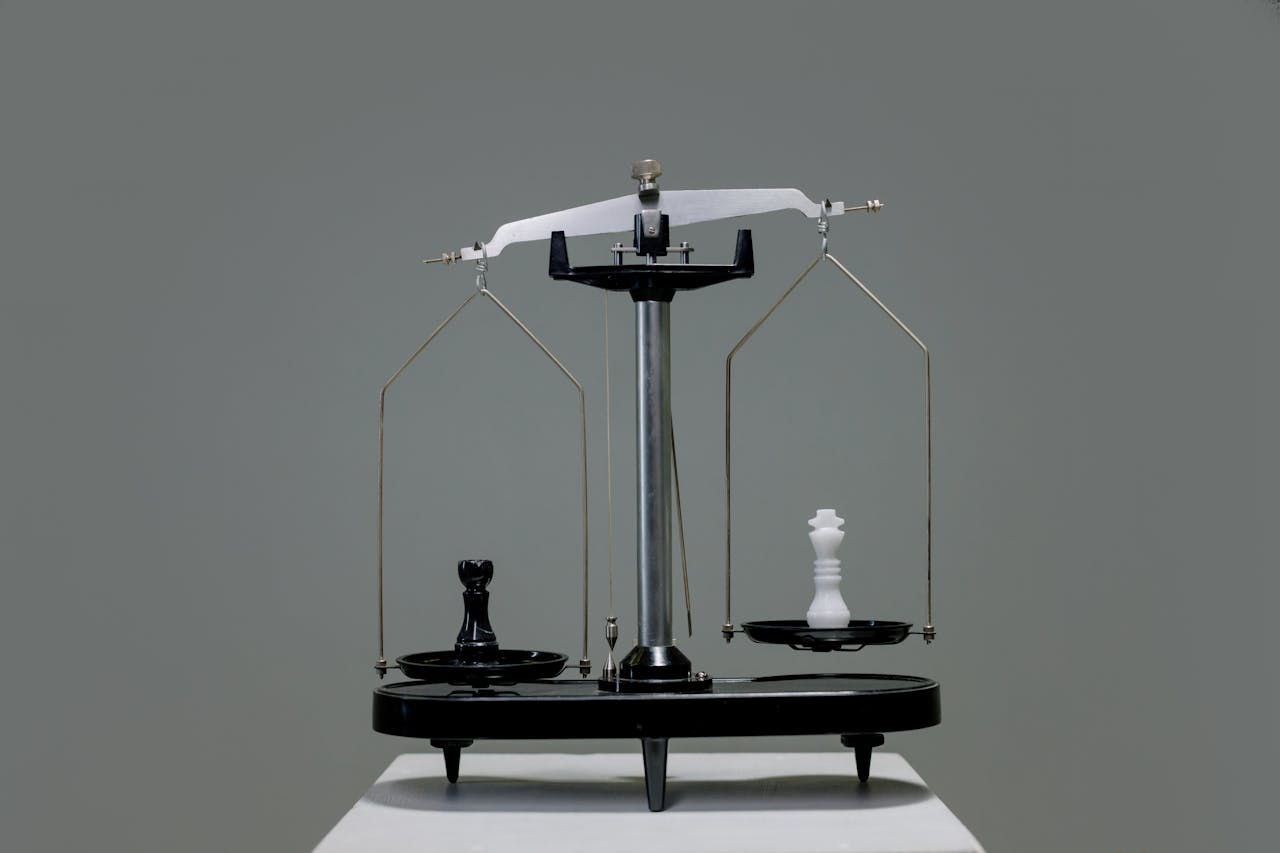

With a Sales-to-New-Listings Ratio (SNLR) of 37%, the GTA was also firmly planted in buyer’s market territory.

As its name implies, a buyer’s market typically favours buyers over sellers, bringing advantages like more choice and less competition.

The Average Property Days On Market (PDOM) also jumped 11.4% in August, going from 44 to 49 days.

In other words: buyers didn’t have to rush to purchase a home, suggesting plentiful supply and moderate demand.

What type of homes were buyers interested in?

August 2025 GTA Home Prices By Property Type

Here’s a year-over-year breakdown of prices by property type:

- Detached Houses: down 7.5% $1,312,240

- Semi-Detached Houses: down 4.2% to $980,102

- Townhouses: down 3.8% to $860,178

- Condos: down 5.0% to $642,195

The most expensive property, detached homes, also experienced the biggest decline, plunging a shocking 7.5%.

This was followed by condos, the cheapest property, dropping a massive 5.0%, semi-detached homes by 4.2% and townhouses by 3.8%.

In short: it was a great time to be a buyer, with big discounts on all properties, from the most to the least expensive.

Conversely, the two properties with the biggest price drops (detached homes and condos) also had the most sales.

Detached houses led with 2,411 transactions, followed by condos at 1,369, townhouses at 927 and semi-detached at 441.

Global News informs:

The largest increase was in the detached segment, which was up 5.9 per cent, followed by semi-detached houses with a 2.6 per cent increase and townhouses with a 2.4 per cent increase.

Condos were the exception, with sales falling 4.9% year-over-year.

August 2025 was a great month for homebuyers, offering more choice, little competition and deep discounts on all properties.

Could an interest rate cut in September tempt even more buyers to enter the market?

September Interest Rate Announcement

According to The Globe and Mail: 62%.

Money markets put it even higher, giving it a 70% chance.

That would take the BoC’s key policy rate from 2.75% to 2.50%.

The impact of a rate cut on homeowners would be almost immediate.

For example, homeowners with a variable rate mortgage (VRM) would save up to $115 a month or $1,368 per year on the average GTA home, while those with a fixed rate mortgage (FRM) would save up to $130 a month or $1,500 per year.

RE/MAX’s 2025 Fall Housing Market Update reveals that 54% of buyers think autumn will be an ideal time to “strike a deal.”

Lower interest rates would only provide additional incentive.

Furthermore, TD, CIBC, BMO and National Bank all predict more rate cuts after the September announcement, with National Bank forecasting a 2% overnight rate by year’s end.

Lower rates, more inventory and falling prices would all lead to more buying activity.

TRREB agrees:

Further relief in borrowing costs would see an increased number of buyers move off the sidelines to take advantage of today’s well-supplied market…

As rates fall and more buyers enter the market, home sales, competition and prices are expected to rise, all to the benefit of sellers.

Advice For Home Buyers

According to Yahoo Finance:

Buyers have the opportunity now to go in and negotiate price, conditions and other things they may want in a contract.

With tons of supply and not enough demand, buyers hold most of the cards during negotiations.

But as Nesto cautions, that could change:

Home prices are already showing signs of a rebound as rates decrease, and the cost of purchasing may soon be significantly higher.

A potential rate cut on September 17th could bring more buyers off the sidelines, leading to stiffer competition and rising prices.

Buyers who act now can also get a deal on all property types, especially condos.

The Globe and Mail informs:

The steepest price decline was among condos in the Toronto suburbs, where the average price fell 10.6 per cent to $594,881 compared with August last year.

But that’s not all: almost 80% of homes sold across the GTA in August 2025 were below list price, “a clear sign that buyers remain in the driver’s seat.”

But they may not remain in the driver’s seat long.

Toronto’s SNLR hit 39% last month, just 1% shy of balanced market conditions (where buyers and sellers are on equal footing).

Experts also predict that home sales and prices will both rebound in 2026, so waiting too long is not without its risks.

For tips on buying a resale property, check out this comprehensive guide.

Advice For Home Sellers

For instance, detached homeowners are in a strong position to sell.

Zoocasa reveals:

Even with softer pricing, demand in this category highlights the enduring appeal of detached living, as households continue to prioritize space, privacy, and long-term value in their purchasing decisions.

In fact, detached homes represented 46.3% of all home sales in August 2025.

Sellers can take advantage of this demand by pricing their properties competitively and offering incentives (e.g. making buyer-requested repairs).

At the other end of the spectrum are condos, which were the only property to see a dip in both sales and prices.

However, condo owners have the advantage of affordability over other properties.

At $642,195, the average condo is less than half the price of a detached house—making them very attractive to first-time homebuyers.

Yahoo Finance confirms:

…smaller, “cookie-cutter” condos are having the biggest price drops…. However, unique condos with a “wow factor” are still selling fairly quickly.

As with detached houses, condos have to be priced competitively and should include perks to lure buyers, such as letting them set the closing date.

A potential interest rate cut will also bring more buyers into the market, giving sellers an opportunity to time their entry.

To prepare your home for sale, check out this guide.

It includes everything you need to know to sell your home, including tips on renovations, improving curb appeal, staging, checklists, and more.

August 2025 GTA Housing Market Conclusion

But as the August 2025 numbers show, buyers are currently enjoying lower prices, abundant inventory, meagre competition, and deep discounts on all property types.

In short: they’re reaping the benefits of a buyer’s market.

But that could all change with a potential interest rate cut on September 17th.

Although lower rates will make life more affordable for current homeowners, it will also bring more buyers into the market, leading to more competition and eventually higher prices.

So serious buyers should consider getting into the market early, before competition and prices heat up.

Have questions about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Re/Max Ultimate Realty Inc., Brokerage

m: 416.903.7032 p: 416-530-1080

f: 416-530-4733

a: 836 Dundas St W Toronto, ON M6J 1V5

w: www.winslai.com e: wins@winslai.com