Overview: a look at how the GTA housing market performed in March 2024, a forecast of what’s to come, plus advice for buyers and sellers.

Spring is a season of rebirth, and that’s what the GTA housing market experienced in March 2024.

The first signs of this renewal were evident in higher home prices and listings, suggesting that both buyers and sellers are coming out of hibernation.

However, lower sales imply that the GTA is still shaking off the winter blues.

So let’s take a look at the March numbers, what they say about the current state of the housing market, what they mean for the future, and what buyers and sellers can learn from them.

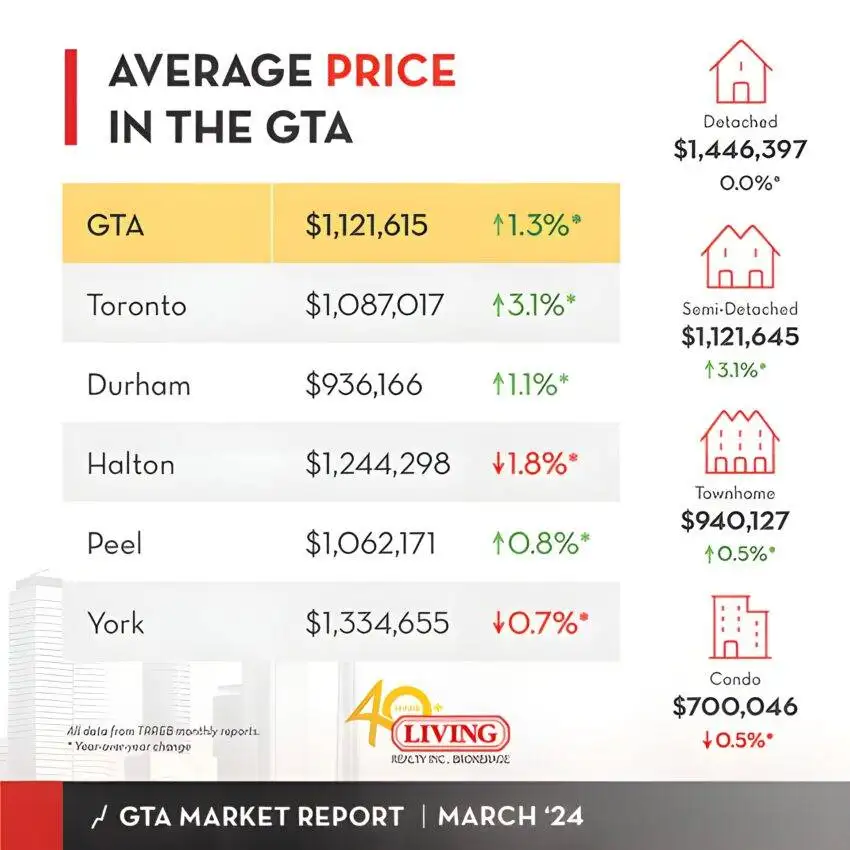

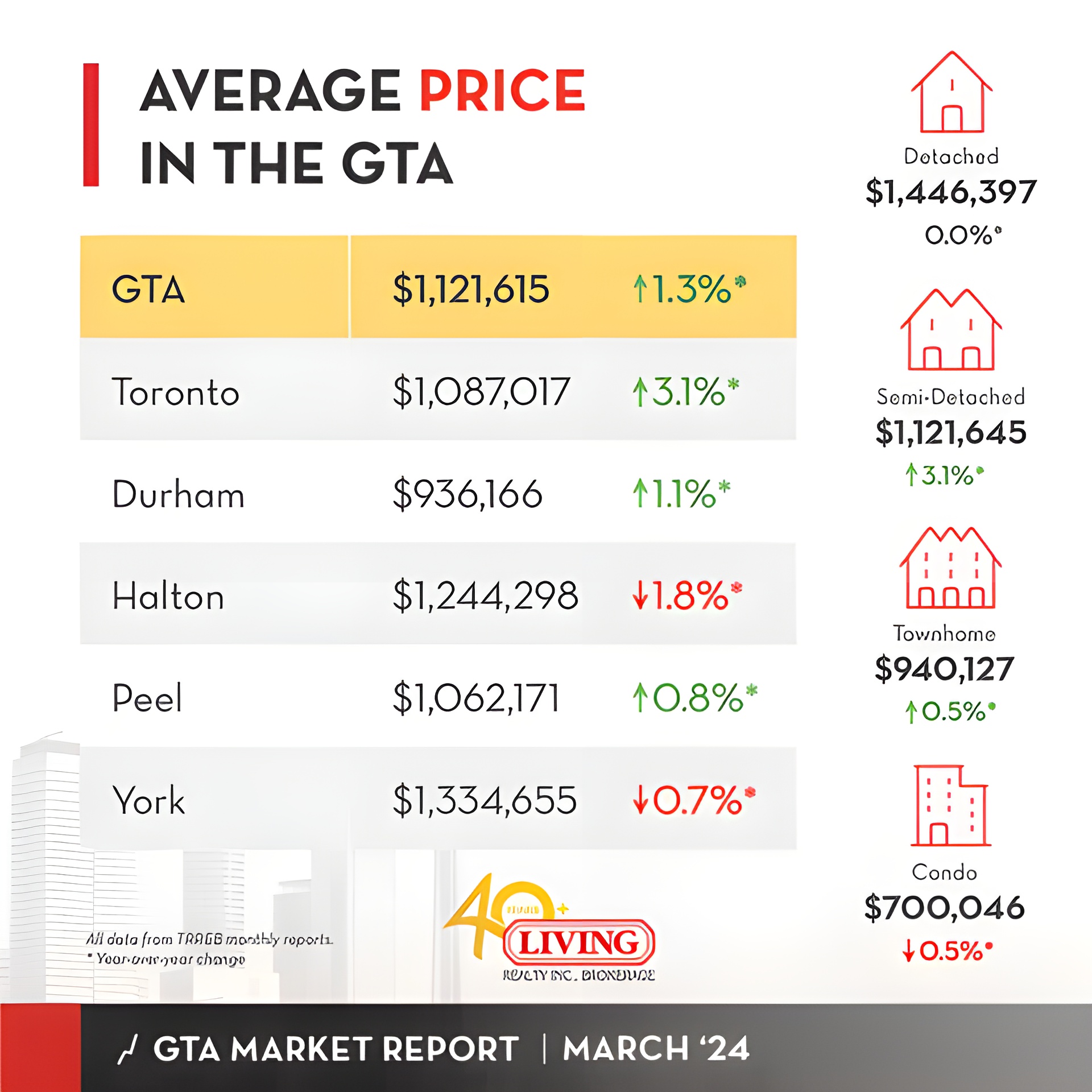

March 2024 GTA Housing Market Numbers

Here’s how March 2024 compares to same period last year:

- GTA Home Prices: up 1.3% to $1,121,615

- Toronto Home Prices: up 3.1% at $1,087,017

- GTA Home Sales: down 4.5% to 6,560

- Toronto Home Sales: down 8.4% to 2,308

- New Listings: up 15.1% to 13,120

In short, prices were up in both Toronto and the GTA, while sales dropped and listings surged.

How could prices rise if sales fell and there was more inventory available?

The Toronto Regional Real Estate Board (TRREB) explains:

Despite a better-supplied market compared to last year, there was enough competition between buyers to see a moderate increase in the average March home price compared to last year’s level.

So there were more listings available for sale, but also enough competition to push up prices.

The month-over-month numbers provide further insight into the spring market.

For example, while sales declined year-over-over in March, they were up 17% from February.

Average home prices also rose 1.2% from February and 9.2% from January, demonstrating strong month-over-month growth.

That month-over-month trend could continue throughout the year.

March 2024 Prices By Property Type

Here’s a year-over-over look at March 2024 home prices by property type:

- Detached Houses: unchanged at $1,466,397

- Semi-Detached Houses: up 3.1% to $1,121,645

- Townhouses: up 0.5% to $940,127

- Condos: down 0.5% to $700,046

The average price of a detached home was $1,466,397 in March, unchanged from a year earlier but up 1.6% month-over-month.

Semi-detached homes performed strongly, rising 3.1% from last year to $1,121,645, but down 0.2% from February.

Townhouses were also up 0.2% year-over-over and 0.6% month-over-month.

Meanwhile, condos were the only property to see an annual price drop, falling 0.5% to $700,046 (but rising 0.6% from February).

Sales were a different story.

On a year-over-over basis, semi-detached home sales rose 4.3% and townhouses by 1.1%.

Detached home sales fell 3%, but that was nothing compared to condos…

According to the Financial Post:

Within the Toronto market, condo sales fell the most, dropping 12.8 per cent year over year and 6.2 per cent from February to March.

On the other hand, condo listings rose for the 9th time in 10 months, with listings reaching an all-time high on a seasonally adjusted basis.

Condos in the 416 also outsold all other property types combined over the last 3 months—showing their growing popularity.

Spring 2024 Forecast

Based on the March 2024 figures, the spring market will likely be more balanced.

Streets of Toronto informs:

The sales-to-new-listings ratio was 50 per cent in March, pointing to a balanced market (anything above 60 per cent is considered a sellers’ market and below 40 per cent is a buyers’ market).

A 50% SNLR is precisely in the middle, favouring neither buyer nor seller.

However, this could all change depending on interest rates.

WOWA predicts:

While the cost of borrowing remains elevated, projected interest rate cuts in late 2024 could inject fresh optimism into the market, potentially easing mortgage burdens for future borrowers.

If the Bank of Canada (BoC) does cut rates, it will spur housing activity, leader to more sales, more competition, and higher prices.

While some experts believe the BoC will cut rates in July, others predict it could be as early as June—still in time for spring.

RBC explains the potential impact of rate cuts:

[It’s] no surprise many sidelined house hunters are eagerly awaiting rate cuts. The rollback of earlier hikes will help restore some buying power and narrow the gap with market prices—provided the latter don’t rise too rapidly.

Lower interest rates means more purchasing power, giving buyers the incentive they need to step off the sidelines and into the market.

But it may take several rate cuts to unlock pent-up demand.

Advice For Home Sellers

By simply waiting…

With interest rate cuts just a few months away, sellers will see a sharp increase in demand, competition and prices.

blogTO agrees:

And, once that pent-up demand is unleashed, fierce competition will likely bring back bidding wars and cause prices to surge even higher.

In fact, it’s already happening in many GTA neighbourhoods.

As Storeys.com informs, the GTA experienced “a wave of overbidding” in March 2024 with the arrival of spring—a sign that the subdued housing market is springing back to life.

Immigration will also have a major impact on home sales and prices.

According to the Financial Post:

Lower interest rates and a stronger economy combined with the strong population growth recorded in 2023 — the highest since the 1950s — are expected to contribute to a recovery in sales…

As mortgage rates and economic uncertainty decrease, buyer confidence will increase.

The result: next year could see home prices match 2022 records, and reach new highs by 2026.

Advice For Home Buyers

Buyers have two advantages on their side: interest rate cuts and condos.

A new report from RBC declares:

We see the growing likelihood of rate cuts starting mid-year as a turning point for housing affordability in Canada. [Lower] borrowing costs will restore some of the massive losses during the pandemic.

Interest rate cuts will mark a turning point for buyers, making homes more affordable and mortgages cheaper.

But buyers don’t have to wait months for lower rates—they’re already here.

Per CP24:

Interest rate drops for fixed-rate mortgages since November have cracked the door open for buyers. And growing expectations the Bank of Canada’s next move will be a rate cut are tentatively bolstering…confidence.

Fixed-rate mortgages have been falling for several months, and affordability will only improve as the BoC cuts its overnight rate.

As interest rates come down, demand for condos will go up.

BNN Bloomberg reveals:

[The] condominium apartment segment of the market is often viewed as an important entry point into homeownership for new buyers.

With 1-bedroom Toronto apartments going for $2,495 per month as of March 2024, many renters are fed up and looking to buy.

Since condos are the cheapest property by far, and interest rate cuts are expected to make them even more affordable, their popularity will only increase.

The good news is that condo prices have been on the decline for the last several months—with no signs of stopping.

March 2024 Market Report Conclusion

With an SNLR of 50%, buyers and sellers were on roughly equal footing.

While sellers enjoyed higher prices, buyers benefited from more listings and lower fixed-rate mortgages.

Thanks to interest rate cuts, spring will see the housing market re-energized.

Sellers will have more competition, resulting in bigger profits

At the same time, buyers will finally see affordability increase and their mortgage payments decrease.

Want to know more about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023