Overview: a look at the November 2024 GTA housing market data, including sales, prices and inventory, the impact of the central bank’s most recent rate cut, and advice for home buyers and sellers.

Five rate cuts—including two jumbo-sized ones—tend to have that effect.

Sales and prices are up, more sellers are listing and buyers are back.

So what did the November 2024 numbers look like, what do they mean for buyers and sellers, and what can they tell us about the future?

Let’s find out…

November 2024 GTA Housing Market Numbers

Here’s a year-over-over look at the November 2024 numbers:

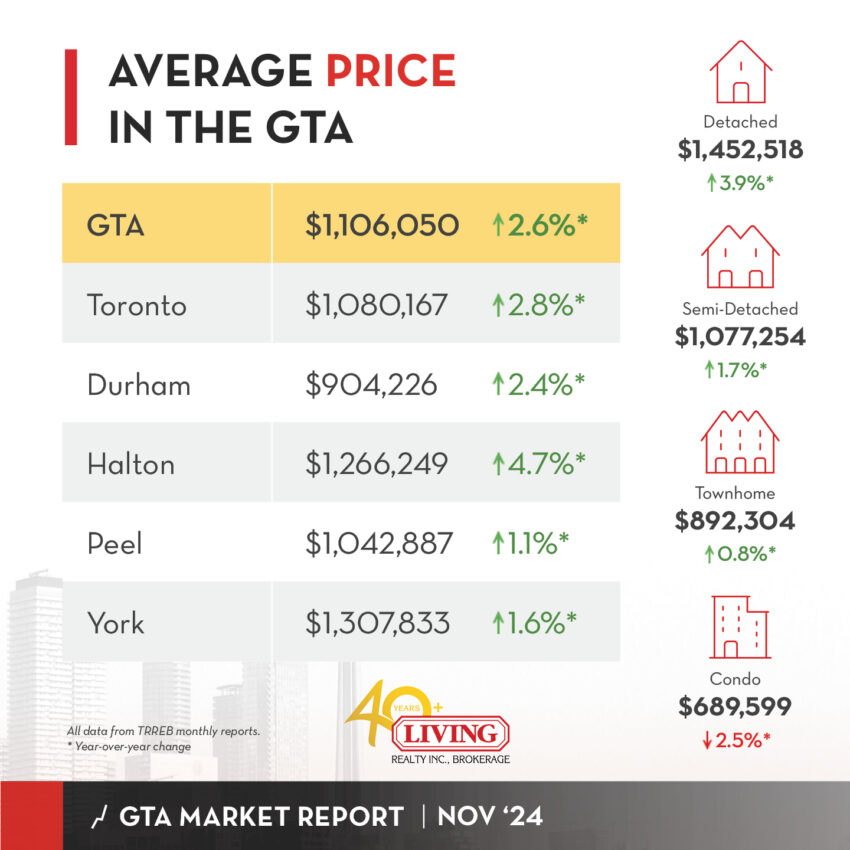

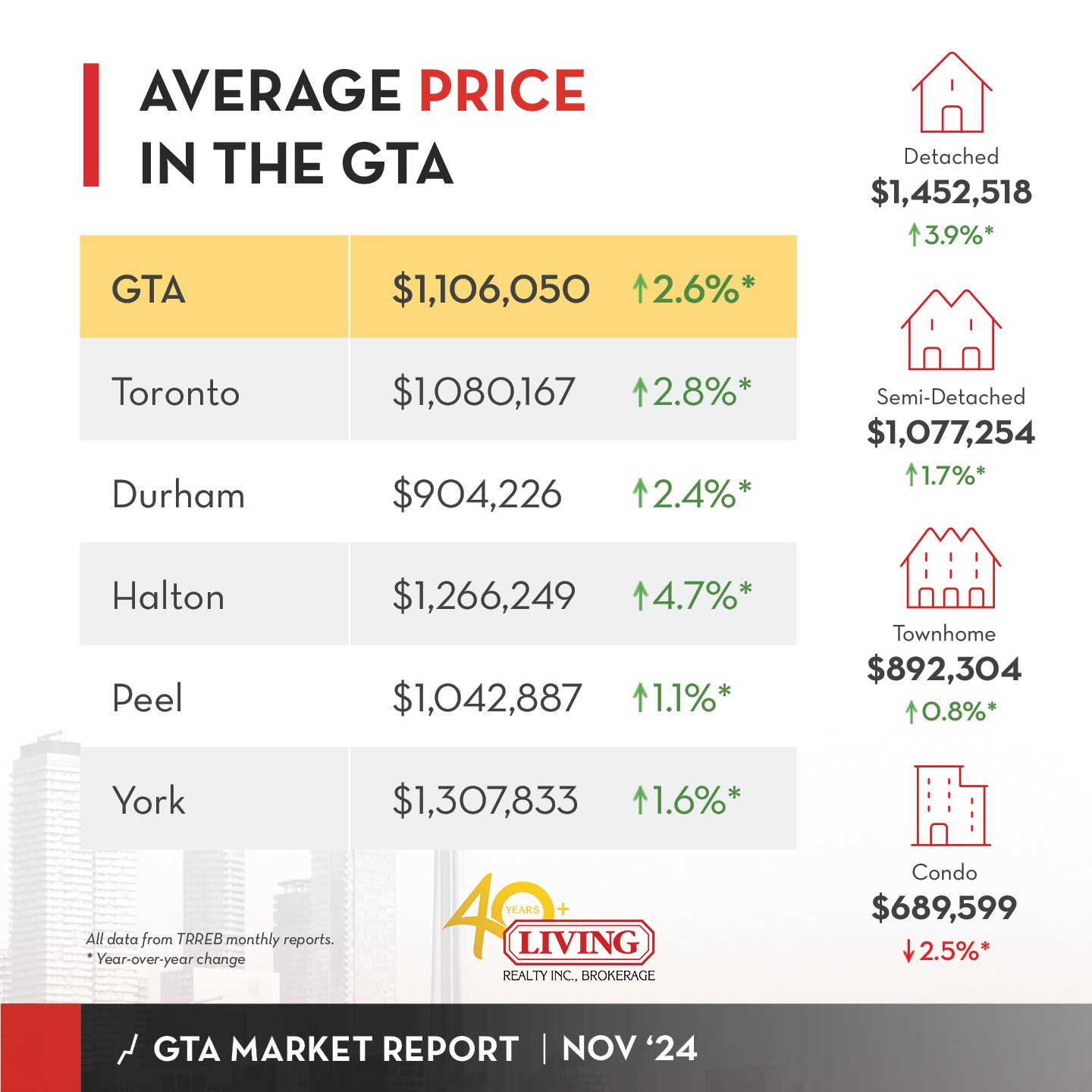

- GTA Home Prices: up 2.6% to $1,106,050

- Toronto Home Prices: up 2.8% to $1,080,167

- GTA Home Sales: up 40.1% to 5,875

- Toronto Home Sales: up 39.1% to 2,236

- New Listings: up 6.6% to 11,592

- Active Listings: up 30.2% to 21,818

Reuters sums up the November market thus:

Greater Toronto Area home sales rose for the fourth straight month in November and prices climbed to a one-year high as lower borrowing costs encouraged buyers to move off the sidelines…

Sales were up four months in a row, prices reached a one-year high, and more buyers entered the market—and it was all because of lower interest rates.

New listings also rose 6.6%—far slower than previous months—suggesting that the market is tightening.

However, the month-over-month numbers tell a different story…

From October to November, GTA home sales fell by 11.8%, home prices by 2.6%, active listings by 10.9%, and new listings by 24.4%.

Should buyers and sellers be worried?

Not according to WOWA:

The much larger rise in home sales relative to new listings meant that November 2024’s sales-to-new-listings ratio (SNLR) jumped to 51%…pushing it further into balanced market territory.

In other words: the GTA is just settling into balanced market territory, and sales and prices are levelling off.

November 2024 Home Prices By Property Type

Here’s a year-over-over breakdown of prices by property type:

- Detached Houses: up 3.9% $1,452,518

- Semi-Detached Houses: up 1.7% to $1,077,254

- Townhouses: up 0.8% to $892,304

- Condos: down 2.5% to $689,599

Condos were the sole outlier, with prices falling 2.5% year-over-over, while townhouse prices finally increased after dropping every month since April.

Conversely, the two most expensive properties—detached and semi-detached homes—have only gotten more expensive.

The Toronto Regional Real Estate Board (TRREB) informs:

Market conditions have tightened, particularly for single-family homes. The detached market segment experienced average annual price growth above the rate of inflation, particularly in the City of Toronto.

With 2,669 sales, detached homes outperformed all other properties in November—which may have something to do with the BoC’s super-sized rate cut the previous month.

Once again, the month-over-month numbers provide a different perspective.

While detached home prices rose 3.9% year-over-over, they fell 0.7% month-over-month, with semi-detached homes and townhouses following suit by falling 2.8% and 1.3% respectively.

Condos had both a bad month and year, with prices dropping 2.9% annually and 0.6% on a monthly basis.

But if interest rates are on their way down, why are prices falling?

November 2024 Housing Market & Interest Rate Cuts

On October 23, the BoC slashed rates by 50 basis points, following it up with another 50 basis point reduction on December 11.

Global News describes the impact of the October rate cut as “the turning point the market had been waiting for.”

For instance, buyers flooded the market, causing home sales to jump 40.1%, while sellers saw prices increase by 2.6%.

But the biggest beneficiary of lower rates was homeowners, who saved thousands on their mortgages.

As Yahoo News informs, this latest cut will bring even more relief:

With five cuts totalling a 1.75 percentage point drop, bringing the overnight rate to 3.25 per cent, monthly payments on [a] $600,000 mortgage would be about $630 less than they were before the BoC began making cuts.

Since the price of the average GTA home is $1,106,050, homeowners will save around $1200 a month on their mortgages—or approximately $14,400 per year!

But as CBC News reports, don’t expect any more jumbo-sized cuts:

The Bank of Canada lowered its interest rate by 50-basis points to 3.25 per cent on Wednesday, but signalled a slower pace of rate cuts moving forward as it focuses on keeping inflation close to target.

So according to the BoC itself, Canadians can expect smaller and less frequent cuts in the future.

This should serve as a clear signal to both buyers and sellers waiting on the sidelines.

Advice For Home Buyers

The BoC has made it clear that the pace and size of rate cuts will slow down, so holding out for another super-sized reduction isn’t recommended.

Instead, buyers should actively be looking at lenders and trying to find properties while there’s still plenty of inventory and limited competition.

This is especially true of buyers who want a house…

Detached home prices have been climbing steadily, rising 1.2% in October and 3.9% in November, suggesting they’ll cost even more down the road.

The good news?

Lower rates make it easier to qualify for a mortgage, and buyers can save thousands on their home loans compared to just a few months ago.

With prices down both year-over-over and month-over-month, condo buyers are in luck.

TRREB informs:

In contrast, the condominium apartment segment continued to experience lower average selling prices compared to a year ago. Condo buyers are benefitting from a lot of choice and therefore negotiating power.

Condo buyers have the benefit of slumping prices, lower borrowing costs, and excess inventory.

That, as blogTO reveals, has led to buyers getting the price they want:

The November 2024 report on underbidding and overbidding…shows that 75 per cent of homes sold in the GTA last month went for less than homeowners were seeking.

Lower prices, ample inventory, greater leverage and falling interest rates—those are all reasons to act now.

Advice For Home Sellers

Rates cuts were supposed to bring back buyers, but as WOWA informs they had a bigger impact on sellers:

We have instead seen a larger influx of sellers who had been waiting to list their homes than a return of buyers, seen through high listing numbers, although November 2024 did see a larger increase in home sales as new listings taper off.

This could change with more cuts, but that may take a while…

Till then, sellers need to be flexible and capitalize on the demand for certain properties.

For example, detached home sales and prices are on the rise, and sellers should act while demand is still strong.

Adapting to balanced market conditions is also crucial.

That means sellers should be prepared to keep their homes on the market for longer (instead of relisting them).

As Zoocasa reveals, patience is also important:

As the expectation grows that sideline buyers will return in 2025, consequently increasing competition and prices, more sellers will start to list their homes for sale.

Although the speed and size of rate cuts is slowing, the BoC is far from finished, with 8 more announcements expected in 2025.

Every rate cut will spur more buyers into the market, giving sellers the opportunity they’ve been waiting for.

In fact, the next rate announcement is on January 29th, a little over a month and a half from now.

November 2024 Market Report Conclusion

Home sales, prices and listings all rose year-over-over in November 2024, but were down on a short-term monthly basis.

That could be due to the temporary euphoria of rate cuts wearing off, or the market settling into balanced territory.

As the November data showed, both buyers and sellers have something going for them, with the former enjoying lower rates, cheaper condos and the ability to negotiate on price.

Sellers have strong demand for detached houses on their side and can look forward to several more rate announcements next year, which will bring even more competition and higher prices.

Have questions about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023