Overview: a look at the October 2024 GTA housing market numbers, including sales, prices and inventory, the impact of rate cuts, and advice for home buyers and sellers.

Our last market report talked about GTA real estate showing signs of recovery.

Since then, the housing market hasn’t just recovered—it’s been completely re-energized.

That may have something to do with the super-sized rate cut last month, or the cumulative effect of 4 rate cuts.

Either way, the GTA housing market is back.

So let’s look at the latest data, what it tells us about the current and future state of GTA real estate, and explore options for would-be buyers and sellers.

October 2024 GTA Housing Market Numbers

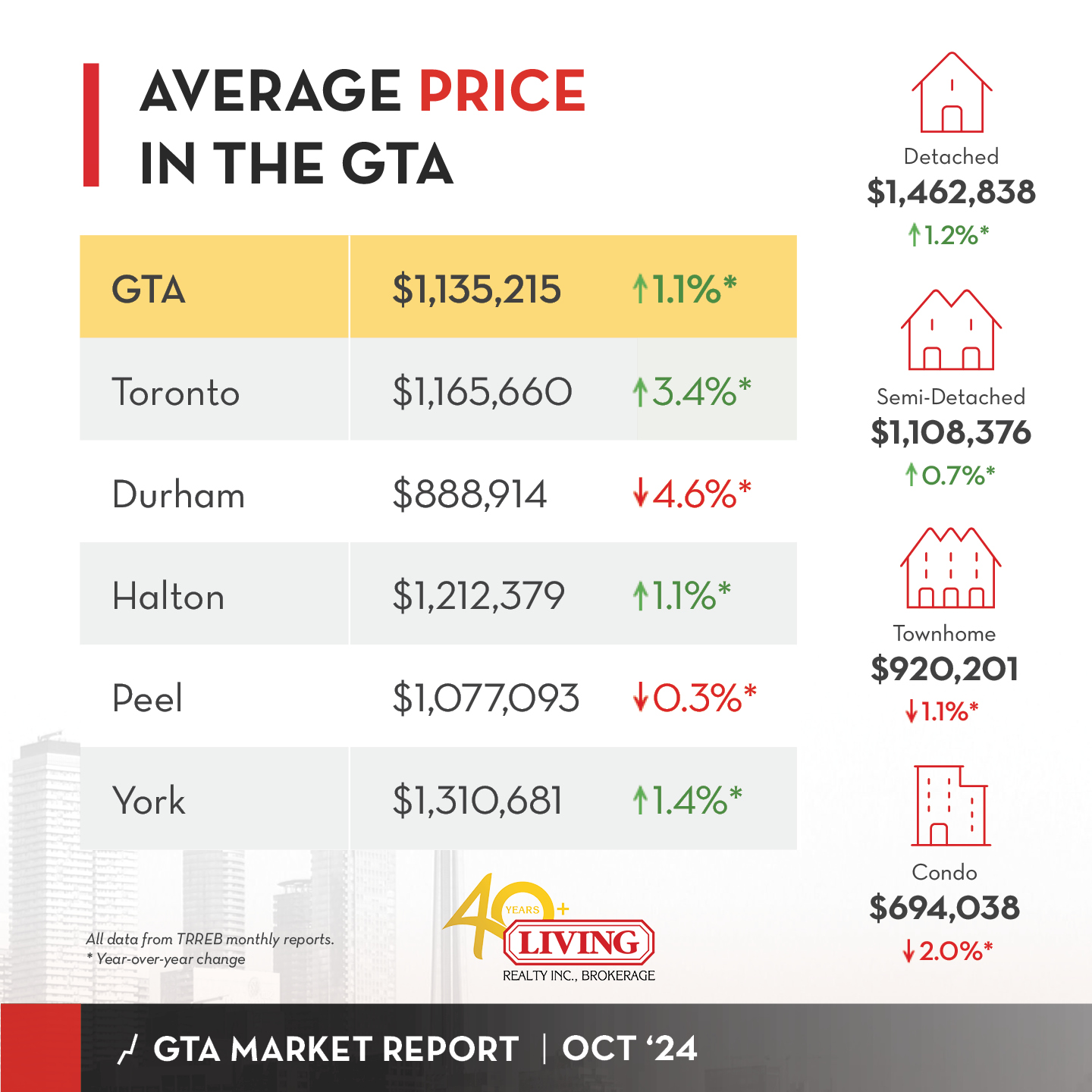

Here’s a year-over-over look at the October 2024 numbers:

- GTA Home Prices: up 1.1% to $1,135,215

- Toronto Home Prices: up 3.4% to $1,165,660

- GTA Home Sales: up 44.4% to 6,658

- Toronto Home Sales: up 36.7% to 2,509

- New Listings: up 4.3% to 15,328

- Active Listings: up 25.3% to 24,481

For example, home sales jumped by high double-digits in both Toronto and the GTA, while prices rose a sizable 3.4% in Toronto.

What was the reason behind this big turnaround?

The Financial Post explains:

The number of homes sold in the Greater Toronto Area (GTA) rose substantially in October, leading industry analysts to suggest that the Bank of Canada’s interest rate cuts had improved affordability and encouraged buyers to re-enter the market

Interest rate cuts led to more buyers entering the market, which caused competition to increase along with home prices.

Even as sales jumped, prices remained flat because new listings rose to their highest levels since 2020.

In other words: there was more than enough supply to meet demand, keeping prices stable.

Both Toronto and the GTA also experienced strong month-over-month growth.

For instance, home prices increased 2.5% in the GTA and 4.5% in Toronto, while sales shot up 33% in the former and 39% in the latter.

Given rising sales and prices, which properties attracted the most attention?

October 2024 Home Prices By Property Type

Here’s how prices by property type broke down year-over-over:

- Detached Houses: up 1.2% $1,462,838

- Semi-Detached Houses: up 0.7% to $1,108,376

- Townhouses: down 1.1% to $$920,201

- Condos: down 2.0% to $694,038

While the two most expensive property types saw prices increase, the two most affordable ones saw them decline.

As Storeys.com reveals, it was a different story when it came to sales:

Of the total homes sold, detached homes continued to lead transactions with 3,139 sales in October 2024, followed by 1,722 condo sales, 1,123 townhouse sales, and 612 semi-detached sales.

Detached homes once again led the way in sales, followed by condos, townhouses and semi-detached properties.

Although condos experienced the biggest price drop, things may be turning around…

According to Real Estate Magazine:

In the past few months, year-over-year growth in condo sales has been relatively low or negative, but in October, condo sales posted pretty significant gains. 32.2 per cent more 416 condos sold this October than last October and similarly, 35.9 per cent more 905 condos sold.

Lower interest rates have made the cheapest property even more affordable, attracting more buyers—especially new ones.

The month-over-month numbers also offer an optimistic outlook for sellers.

From September to October, detached home prices rose 2.8%, townhouses by 2.5%, semi-detached homes by 1.6%, and condos by 1.7%.

So what part do interest rates play in all this?

October 2024 Housing Market & Rate Cuts

For buyers, the October rate cut was the signal they’ve been waiting for.

The Toronto Regional Real Estate Board (TRREB) agrees:

While we are still early in the Bank of Canada’s rate cutting cycle, it definitely does appear that an increasing number of buyers moved off the sidelines and back into the marketplace in October.

TRREB goes on to say that lower borrowing costs and relatively flat home prices have created a picture of affordability, leading to more buying and selling.

For sellers, lower rates have meant regaining some of their lost negotiating power.

WOWA explains:

The much larger rise in home sales relative to new listings meant that October 2024’s sales-to-new-listings ratio (SNLR) jumped to 43%, quite higher than September 2024’s SNLR of 28%, bringing the GTA back into the balanced market territory.

Just last month the GTA was in a deep buyer’s market, but October’s colossal rate cut has brought it back to balanced territory—one which favours neither buyer nor seller.

For homeowners, lower rates have been a financial lifeline.

Nerd Wallet informs:

Slashing the overnight rate by 50 points is no joke where variable mortgage rates are concerned. Once the cut is absorbed by the nation’s lenders, we may see variable rates around 4.8% — the lowest they’ve been since December 2022.

In fact, the average homeowner is now paying almost $5,000 less on their mortgage compared to a year ago!

Advice For Home Buyers

While buyers enjoyed many advantages over sellers during the October 2024 deep buyer’s market, in 30 short days the GTA was back in balanced territory.

The cause? Multiple rate cuts…

So while lower rates do provide some relief, they also drive up prices and competition.

CTV News concurs:

With further rate cuts from the Bank of Canada likely this year, we anticipate prices will appreciate more quickly, eliminating the advantages of waiting for first-time buyers and making calculations more favourable for investors.

Every rate cut means more buyers, more competition and higher prices.

However, there’s still time…

blogTO reports:

As of October, the vast majority of the region is still in “underbidding territory,” with prices for all housing types — especially condos — also down slightly across the board compared to the same time last year.

Although the GTA is no longer in a deep buyer’s market, many parts of it are in “underbidding territory,” giving buyers the chance to negotiate lower prices.

What should they buy?

While detached homes seem to be the most popular property, leading the way in sales and prices, condos remain the most affordable.

Following last month’s 2% price drop, they’re even more affordable.

Plus with supply continuing to exceed demand, condo buyers have less competition, more choice, and the ability to negotiate with sellers.

In short: it’s still a deep buyer’s market when it comes to condos.

Advice For Home Sellers

According to WOWA:

Active listings in October 2024 have now slightly leveled off to 24,481, down 4.4% monthly… Meanwhile, 15,328 new listings were added in October 2024…down 15.3% compared to September 2024.

As sales surged listings fell dramatically month-over-month, indicating that demand is on pace to overtake supply.

But that doesn’t mean sellers should expect to get a higher price the longer the wait.

For one, the GTA is in balanced market territory with buyers and sellers being evenly matched.

For another, while buyers are returning, the vast majority of the GTA is still in underbidding territory.

blogTO informs:

…88 per cent of the GTA that is now being underbid when looking geographically, while 70 per cent of homes sold over the course of the month regardless of address went for less than sellers had been hoping to get…

The lesson: set a realistic price based on current trends, not previous highs.

Average Days on Market also increased 28.6% in October from 21 to 27.

That means sellers should exercise patience and be prepared to wait till the right buyer comes along.

Finally, though new listings are falling, inventory is still rising, which can result in properties spending more time on the market—dragging down prices.

For that reason, sellers need to competitively price their listings and be prepared to negotiate with buyers.

October 2024 Market Report Conclusion

October 2024 saw sales skyrocket and prices climb as the BoC’s rate cuts were enough to draw back reluctant buyers.

Homeowners benefited by saving thousands on their mortgages, while sellers saw more competition and higher prices.

Buyers also enjoyed more choice with an uptick in listings, could take their time with a higher days on market, and still retained their negotiating power in many parts of the GTA.

The Bank of Canada is almost certain to cut rates again on December 11th, further adding fuel to the housing market fire.

Want to know more about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023