Overview: a look at the May 2024 GTA housing data, including sales, prices and listings, plus the potential impacts of the June 5th interest rate cut on buyers and sellers.

In our last Market Report, we made the following prediction:

If the Bank of Canada (BoC) does cut rates, it will spur housing activity, leading to more sales, more competition, and higher prices.

Well, that day has finally arrived.

On June 5th, the Bank of Canada (BoC) cut interest rates—the first time in over four years.

How will this rate cut affect home sales, prices and inventory?

And what should buyers and sellers do to prepare for a potentially hot housing market?

Let’s find out…

May 2024 GTA Housing Market Numbers

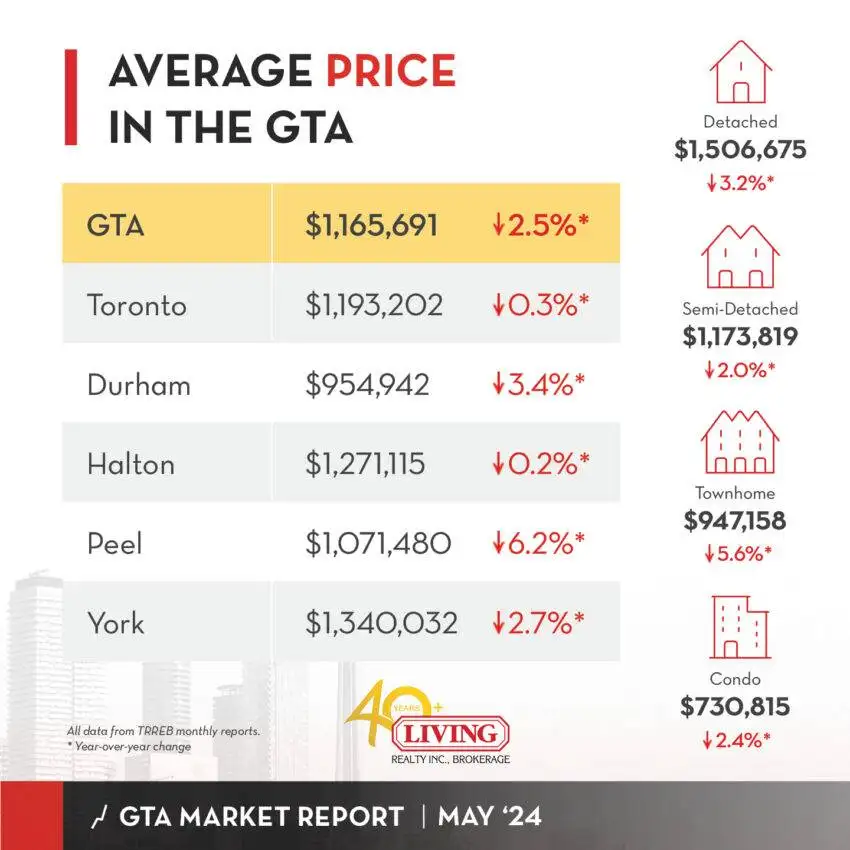

Here’s how May 2024 compares to May 2023:

- GTA Home Prices: down 2.5% to $1,165,691

- Toronto Home Prices: down 0.3% at $1,193,202

- GTA Home Sales: down 21.7% to 7,013

- Toronto Home Sales: down 17.8% to 2,701

- New Listings: up 21.1% to 18,612

Sales and prices were both down, while inventory shot up.

In other words: sellers were listing, but not many people were buying, resulting in lower prices.

The Toronto Regional Real Estate Board (TRREB) explains why:

May home sales continued at low levels… Home buyers are still waiting for relief on the mortgage rate front. Existing homeowners are anticipating an uptick in demand, as evidenced by a year-over-year increase in new listings.

So sales fell because buyers were waiting for lower interest rates, and homeowners, expecting a rate cut, started putting their properties on the market, causing listings to jump.

On a month-over-month basis, GTA home prices rose 0.8%, while sales dipped 1.4%.

The Sales-To-New-Listings Ratio (SNLR) also dropped to 38%, putting the GTA in buyer’s market territory.

With more choice and less competition, buyers could afford to negotiate lower prices.

But now that interest rates have dropped, we can expect sales and prices to pick up.

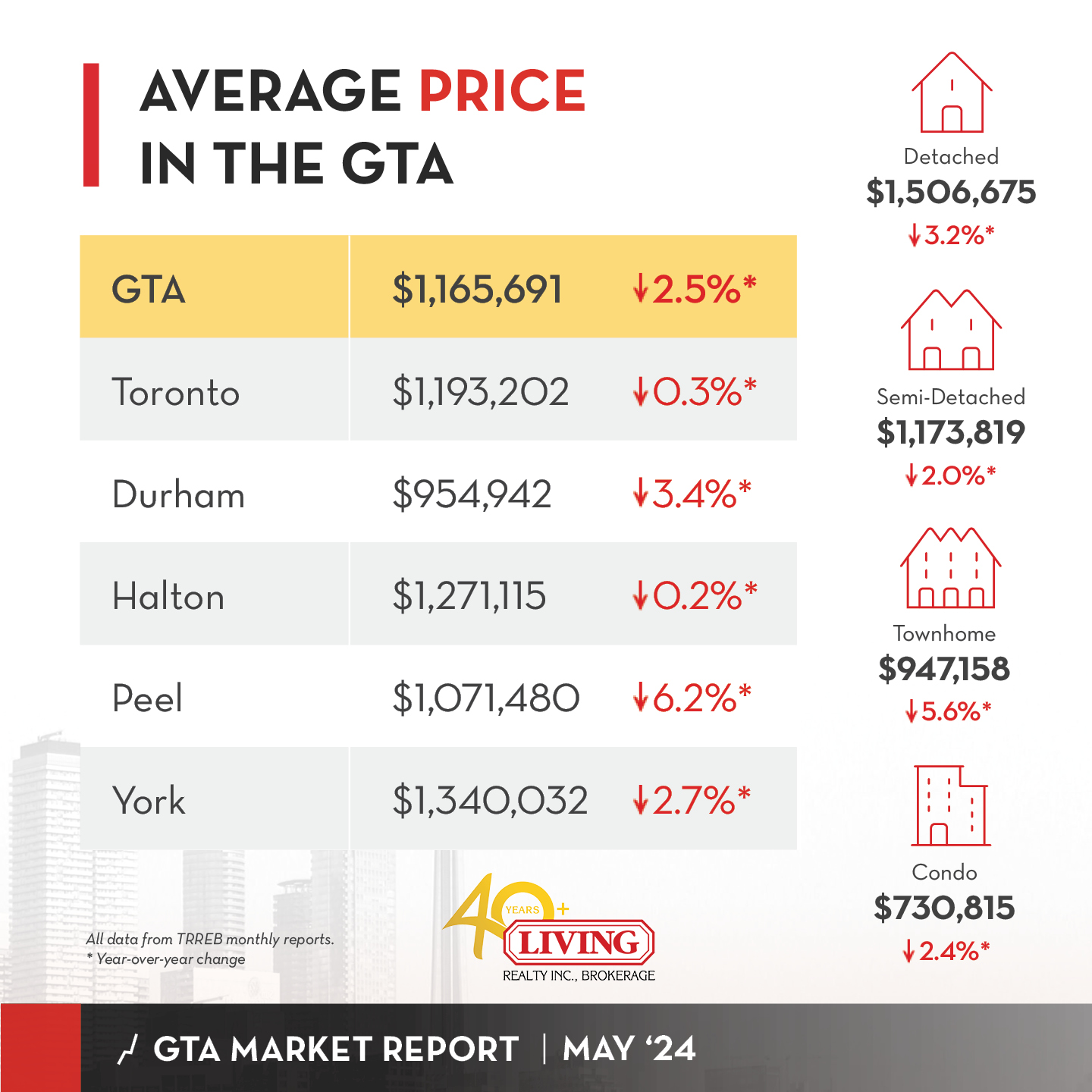

May 2024 Home Prices By Property Type

Here’s a year-over-over breakdown of prices by property type for May 2024:

- Detached Houses: down 3.2% $1,506,675

- Semi-Detached Houses: down 2.0% to $1,173,819

- Townhouses: down 5.6% to $$947,158

- Condos: down 2.4% to $730,815

It turns out, all properties had a pretty bad month.

Sales were even worse.

BNN Bloomberg reports:

All property types saw fewer sales in May compared with a year ago throughout the GTA. Townhouses and condos led the drop, with 24.3 and 24.1 per cent fewer sales…

They were followed by semi-detached homes at 21.3%, and detached homes at 19.4%.

In short, every GTA property experienced a double-digit decline in sales.

Condos, however, were the hardest hit.

While condo sales were down 24.1% compared to last year, the number of active condo listings soared 89%, reaching a record of 9,951 units.

But now that the BoC has started cutting interest rates, will GTA home sales and prices recover?

It certainly seems so…

Impact of The June 2024 Rate Cut

Yahoo Finance explains why even such a small amount is significant:

The first cut may not necessarily be the deepest, but it is the most significant, as it marks the official turning point after more than two years of restrictive policy.

So a 25 basis point cut seems minor, but it marks a major shift in the BoC’s policy.

Mortgage holders will see instant relief because of the rate reduction.

Global News informs:

Homeowners with variable-rate mortgages…will immediately see their interest rates drop by 25 basis points.

Depending on the price of their home, borrowers can save up to $1,100 per year.

But it’s not just variable rate holders who will benefit, but nearly 2.2 million Canadians who have to refinance their mortgages this year and in 2025.

Zoocasa predicts lower rates will spur more housing activity:

Now that rates have dropped, increased buyer confidence is expected to stimulate the market, leading to a rise in home sales and home prices.

As more buyers step off the sidelines and into the market, it will lead to more competition and higher prices.

Finally, experts believe it will take another 3-4 rate cuts before borrowers see meaningful relief.

The good news is that the next rate cut maybe just a month away (July 24th).

The better news: banks are forecasting 3 more rate cuts this year, which could bring interest rates down to 4%!

Advice For Home Buyers

For one, prices and interest rates are both down.

For another, listings are skyrocketing while sales are down over 20%, giving buyers more choice and less competition.

Sales, prices, listings and interest rates—they all favour buyers.

But as Zoocasa reminds us, that could change with the latest interest rate cut:

[In] late 2020 and early 2021, when borrowing costs were at their lowest, home prices skyrocketed. It wasn’t until the overnight lending rate started to climb that home price growth began to slow down.

Any drop in interest rates will likely be offset by higher sales and prices, just as we saw during the pandemic.

So instead of waiting for the BoC to cut rates even more, buyers should start looking for homes within their budget, compare lenders, and get pre-approved for a loan.

If you do decide to buy, consider getting a variable rate mortgage, which are expected to fall quickly in the following months.

Finally, buyers should consider purchasing a condo.

At $730,815, they’re twice as cheap as a detached house ($1,506,675).

Condo sales were also down 26% in May 2024 as active listings shot up 89%, reaching a record 9,951 units.

Move Smartly informs:

Investors are rushing for the exits. Higher interest rates are driving up mortgage payments, making condominium investing far more expensive.

Not only are condo prices falling, but there’s a ton of inventory for sale, making now the ideal time to buy.

Advice For Home Sellers

Nerd Wallet offers this optimistic outlook:

…home buyers waiting patiently for rates to fall will see the Bank of Canada’s rate announcement as a signal that buying power is about to improve for everyone. If you listen carefully, you can probably hear their FOMO alarms going off.

While a 25 basis point reduction won’t bring back every reluctant buyer, many will return because of FOMO (i.e. the Fear Of Missing Out).

This is important, because as Nerd Wallet goes on to say, the housing market feeds on buyer perception.

As interest rates drop even more over the coming months, a greater number of buyers will enter the market and competition will heat up.

The result:

For buyers, this means they may have to move at a faster pace than they were previously used to, while for sellers, this could present a good opportunity for quicker sales.

More competition, higher prices, and faster sales—these are some of the reasons sellers should be getting ready to list.

While interest rates are coming down, they won’t come down all at once, but over a period of several months.

Per CBC News:

[The] Bank of Canada is going to take things “one meeting at a time.”

In fact, economists put the chances of a July rate cut at 39%.

My advice to sellers is the same as to buyers: don’t keep waiting for a better opportunity.

May 2024 Market Report Conclusion

And it’s all thanks to interest rates, which are finally on their way down.

The outcome will favour both buyers and sellers: an increase in sales and prices for sellers, more affordable mortgages for buyers, and the construction of more homes for everyone.

As Yahoo Finance declares:

This rate cut is the green light homebuyers have been waiting for, and it’s a win-win for both buyers and sellers, setting the stage for a dynamic and competitive market…

Have questions about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023