Overview: a look at the Bank of Canada’s October rate cut of 50 basis points, its implications for the GTA housing market, and advice for buyers and sellers.

Since inflation eased to 1.6% in September, experts have been predicting a larger-than-usual rate cut from the central bank—and they were right.

On October 23, the BoC slashed interest rates by 50 basis points from 4.25% to 3.75%.

Global News reports:

Wednesday’s decision is the fourth consecutive drop in interest rates since June and is the Bank of Canada’s largest rate cut since the global financial crisis in 2009, outside the COVID-19 pandemic.

In fact, the last time the central bank cut rates by half a percent was on March 27, 2020.

So how does the oversized October rate cut affect the GTA housing market?

What does it mean for home sales and prices?

And how can buyers and sellers use the latest rate cut to their advantage?

Let’s find out…

Impact Of October Rate Cut On Mortgages

Global News informs:

Wednesday’s sizeable interest rate cut offers immediate relief to Canadians with variable rates of interest and bodes well for those with mortgages coming up for renewal.

Variable rate mortgage (VRM) holders will see a considerable drop in their monthly home loan payments.

According to Ratehub, every 25 basis point reduction in interest rates means you pay $15 less per $100,000 of mortgage.

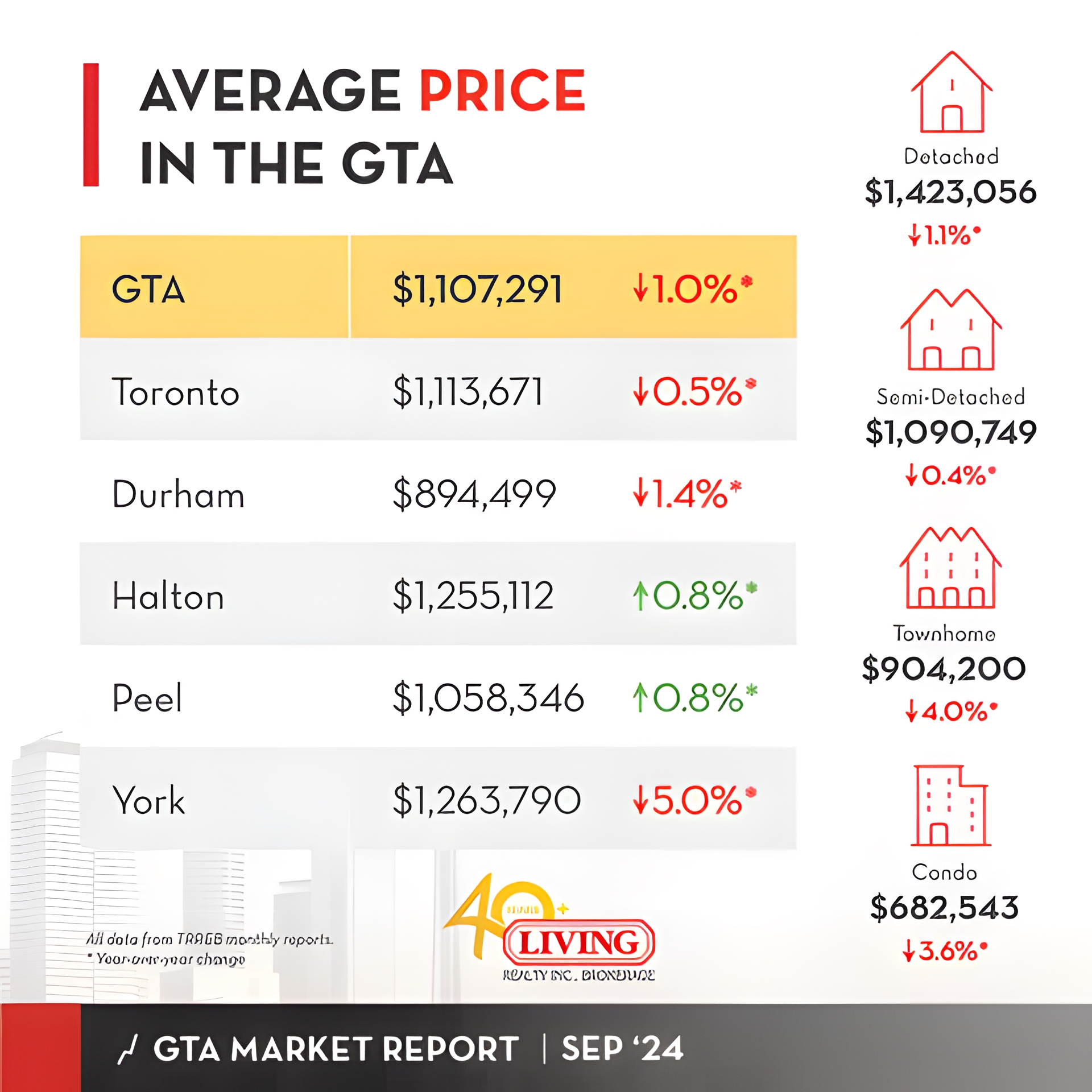

Since the average price of a GTA home is $1,107,291, the October rate cut of 50 basis points translates to a monthly savings of $166, or $1,993 annually.

But if we take all 4 rate cuts into account (a total of 125 basis points), that works out to $415 per month—or $4,982 per year!

So thanks to interest rate cuts, homeowners are paying almost $5,000 less this year compared to 2023.

Another affect of the BoC’s rate cuts is on the type of mortgages Canadians are choosing.

The Canadian Mortgage and Housing Corporation (CMHC) finds that 69% of Canadians have a fixed rate mortgage (FRM) while only 23% have VRMs.

However, according to Reuters:

Variable rate mortgages began to gain popularity earlier this year, as the central bank started cutting rates in June.

As interest rates fall further, more Canadians are likely to opt for VRMs due to greater savings.

And there’s more rate cuts on the way…

2024-2025 Interest Rate Forecast

While there won’t be an interest rate announcement in November, the good news is that there will be one on December 11th.

The even better news: experts are 100% certain that the BoC will cut rates again, but by how much remains a mystery.

For example, Desjardins believes the pace of rate cuts will slow down over the coming months, with a 25 basis point cut in December followed by six more in 2025.

That would take us from 3.75% to 3.50% by the end of 2024, and 2% by the end of 2025.

But Scotiabank disagrees with Desjardins, arguing that the BoC has left the door open to another jumbo-sized reduction similar to the October rate cut.

If the BoC wanted to say this was an unusual one-and-done upsizing, then they could have easily done so… The fact they did not…was a dovish signal that sets a low bar for data to guide another large cut.

RBC is even more aggressive in its forecast:

As such RBC sees the overnight rate hitting 2 per cent by July…a touch below the lower bound of the BoC’s own estimates…

In order to reach that 2% target, the BoC would need to cut interest rates by another 175 basis points over the next 9 months.

As such, RBC predicts another 50 basis point cut in December, followed by a series of smaller cuts throughout the first half of 2025.

Impact Of Rate Cuts On Sales & Prices

So what will it take for sales and prices to pick up?

BNN Bloomberg explains:

With every cut to the overnight lending rate, more homebuyers are expected to come off of the sidelines. In turn, rising demand will cause home prices to increase more rapidly, eliminating the advantages of lower borrowing costs…

As interest rates drop, buying activity will increase along with affordability.

And as that happens, competition will ramp up, driving prices higher and offsetting the savings from lower rates.

We can find proof of this in last month’s housing data.

While home prices were down year-over-over in September, sales were up.

The month-over-month numbers provide an even better sense of the market recovery.

For example, while prices fell 1% year-over-year, they actually rose 3.1% from August to September, thanks to lower borrowing costs.

Despite the rate cuts, the housing market recovery won’t be immediate.

According to Rates.ca:

While this will likely encourage some buyers to enter the market and may encourage more sellers to list in anticipation of these buyers, it’s likely that many will wait for the final rate announcement of the year before making a move.

The October rate cut of 50 basis points may be enough to motivate some buyers and sellers, but others will wait till the end of the year before deciding to act.

What should buyers and sellers do till then?

Advice For Home Buyers & Sellers

For buyers, the time to act is while interest rates are falling but before prices start rising.

BNN Bloomberg cautions:

But things are definitely bubbling beneath the surface, and another rate cut could be the catalyst for a busy market in early 2025, and tightening conditions by spring…

To avoid this scenario, buyers should consider getting into the market over the next few months.

Perhaps the biggest reason for buyers to act now is the fact that the GTA is in a deep buyer’s market.

As WOWA explains:

A buyer’s market, which Toronto’s housing market is currently in, can create opportunities for individuals looking to enter the housing market or upgrade their current living situation.

Thanks to supply overwhelming demand, buyers have far more choice, way less competition, and a lot more negotiating power.

Unlike buyers, sellers just have to exercise patience.

Yahoo Finance informs:

…once the market begins to move, it’s likely to heat up quickly, pushing home prices higher. This may lead to an unseasonably busy winter season, and a busy spring season in 2025…

The fact is, every rate cut brings more buyers off the sidelines and into the market.

That was true of the previous rate cuts (as seen by September’s month-over-month numbers), and it will be true of the super-sized October rate cut.

October Rate Cut Conclusion

The super-sized rate cut of 50 basis points will help homeowners save thousands on their mortgages.

For buyers, it may just be the motivation they need to step off the proverbial sidelines and into the market.

For sellers, it means more competition, less time negotiating and hopefully higher prices.

While it’s too early to tell how much December’s rate cut will be, one thing is for sure: the BoC isn’t done its rate-cutting campaign.

Have questions about interest rates? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023