Overview: a look at the September 2024 GTA housing market data, the impact of previous rate cuts, predictions for future rate cuts, and advice for buyers and sellers.

August was a brutal month for GTA real estate, with both sales and prices dropping despite the Bank of Canada (BoC) slashing interest rates for the third time.

September was slightly better, but it may be the start of a positive trend—one that benefits both buyers and sellers.

So let’s look at the September 2024 numbers, what they mean for the current state of the housing market, and what they may forecast for the coming months.

September 2024 GTA Housing Market Numbers

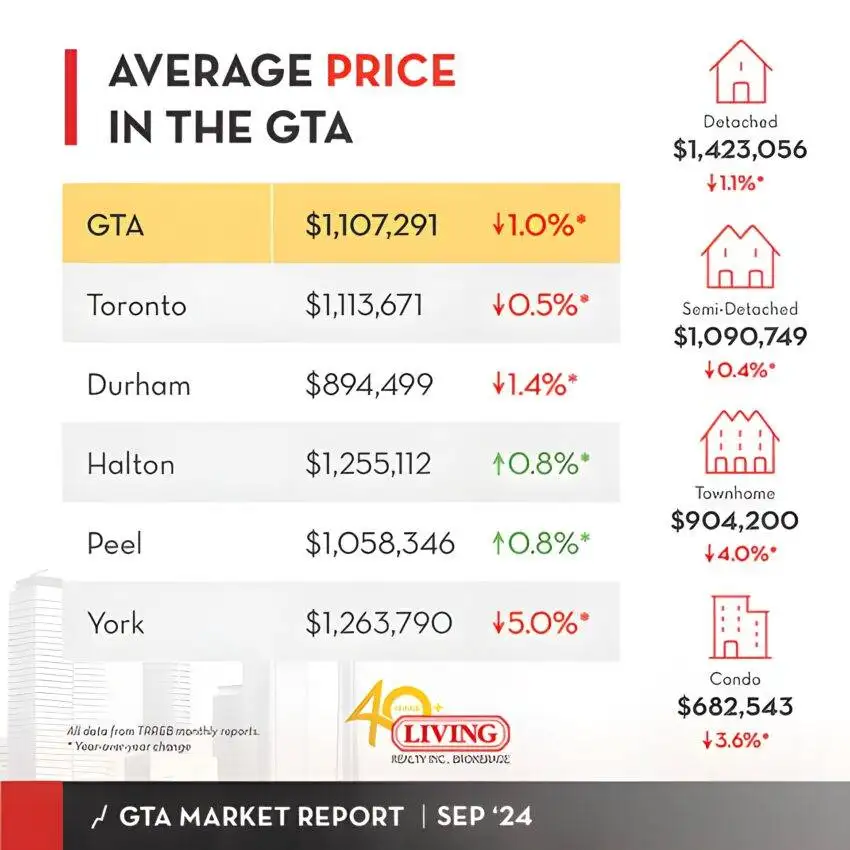

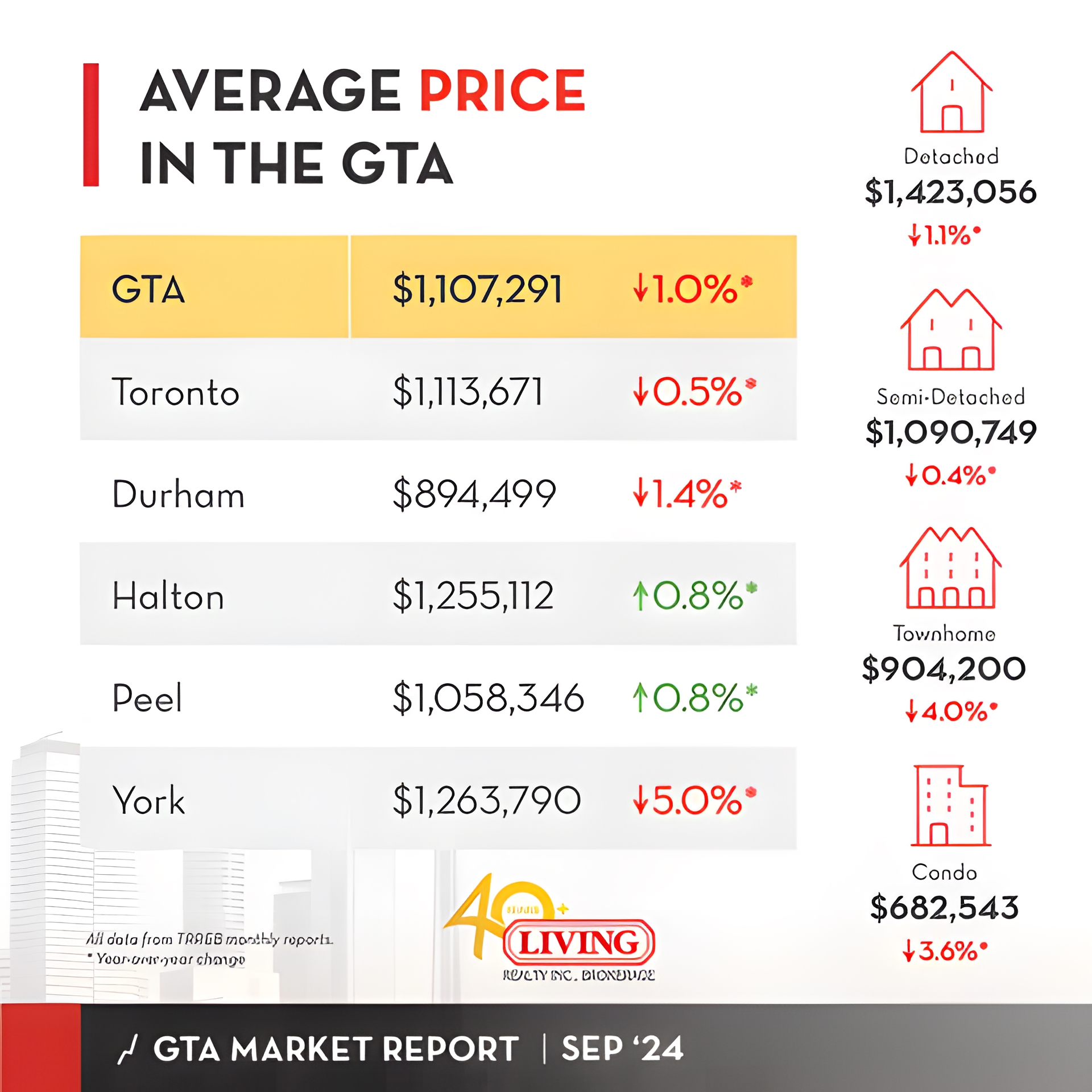

Here’s a year-over-over look at the September 2024 numbers:

- GTA Home Prices: down 1.0% to $1,107,291

- Toronto Home Prices: down 0.5% to $1,113,671

- GTA Home Sales: up 8.5% to 4,996

- Toronto Home Sales: up 3.7% % to 1,808

- New Listings: up 10.5% to 18,089

- Active Listings: up 35.5% to 25,612

So why did prices fall if there were more buyers?

The Toronto Regional Real Estate Board (TRREB) explains:

The annual improvement in September home sales was more than matched by the increase in new listings over the same period. This resulted in a better-supplied market and increased negotiating power for buyers re-entering the market.

In other words: the rise in buyers was balanced out by a double-digit spike in listings, serving to keep competition (and thus prices) low.

At the same time, Average Listings Days on Market (LDOM) rose 35% to 27 days, showing that not only were there more properties available for sale, but they took longer to sell.

The month-over-month numbers provide a closer look into sales and price trends.

From August to September, listings increased by 11%, sales by 0.4%, and prices by 3.1%.

So while the year-over-over numbers were mixed, on a monthly basis sales, prices and inventory all increased.

With all the buying activity last month, which properties were popular?

September 2024 Home Prices By Property Type

Here’s a year-over-over breakdown of prices by property type:

- Detached Houses: down 1.1% $1,423,056

- Semi-Detached Houses: down 0.4% to $1,090,749

- Townhouses: down 4.0% to $904,200

- Condos: down 3.6% to $682,543

All properties experienced price losses, with townhouses and condos leading the way.

TRREB reveals the reason:

The ability to negotiate on price led to moderate year-over-year price declines, particularly in the more affordable condo apartment and townhouse segments, which are popular with first-time buyers…

Once again, ample inventory gave buyers greater negotiating power, causing condo and townhouse prices to slide even lower.

When it comes to condos, Toronto doesn’t just have ample inventory, but an excessive and rising supply.

Condo listings have skyrocketed 52.8% from last year, and with so much supply and a lack of buyers, it’s only natural for prices to drop.

While they were down on a yearly basis, prices actually headed up month-over-month.

With the exception of townhouses, which declined by 0.9%, semi-detached home prices rose by an impressive 6.3%, condos by 1.2%, and detached home prices by 0.6%.

So on a year-over-over basis, prices for all properties were down in September 2024, but on a shorter monthly time-frame, most of them trended up.

And the most likely reason behind rising sales and prices is interest rates.

September 2024 Housing Market & Interest Rates

For proof we just need to look at the May 2024 numbers (one month before the first rate cut) when home sales were down 21.7% and prices fell 2.5%.

Since then, sales and prices have been steadily climbing as buyers slowly return to the market.

The Toronto Star reports:

With every interest rate cut we’re expecting you’ll see a larger number of buyers wanting to purchase and move off the sidelines…

But even with lower rates and higher inventory, many buyers—especially new ones—are taking a wait-and-see approach.

So how many rate cuts will it take for first-time buyers to act?

According to experts:

…first-time homebuyers need to see an interest rate drop of around two per cent from the Bank of Canada…

So, home sales and prices will pick up after interest rates come down at least 2% from 4.25% to 2.25%.

When can we expect that?

RBC offers the following timeline:

As a result, we updated our forecast to expect two back-to-back 50 bps reductions in the overnight rate in October and December before a return to slower 25 bps cuts at every meeting after.

That would put rates at 2.25% by June 2025—a mere 8 months from now.

Till then, we can expect both sales and prices to accelerate, especially if there’s a 50 basis point cut on October 23.

Advice For Home Buyers

As the September 2024 numbers show, the market is on the side of buyers.

WOWA agrees, stating:

However, the much larger rise in new listings meant that the month’s sales-to-new-listings ratio (SNLR) fell to 28%, far below August 2024’s SNLR of 39.7%, and plunged the market deep into buyer’s market territory.

Once again, the GTA is in a deep buyer’s market.

As its name implies, a deep buyer’s market heavily favours buyers over sellers, offering them the following perks:

- Lower prices

- Less competition

- More choice

- A more leisurely buying process

- Greater leverage during negotiations

Right now buyers can take advantage of all of the above, but that may not be the case in the coming months.

Wealth Professional warns:

[The] Bank of Canada’s anticipated rate cuts later this year could spur more buyers and investors to enter the market. [Expect] home prices to rise faster, erasing the benefits of waiting for first-time buyers…

As interest rates come down, perhaps a full 1% by the end of December, more and more buyers will return, driving up sales and prices.

And as the month-over-month figures show, home sales and prices are already on the rise.

Advice For Home Sellers

The same thing working in favour of buyers is helping sellers: lower interest rates.

For the former, it means more affordable mortgages; for the latter, it means more competition and higher prices.

CTV News concurs:

With further rate cuts from the Bank of Canada likely this year, we anticipate prices will appreciate more quickly, eliminating the advantages of waiting for first-time buyers…

So interest rate cuts will lead to faster price growth, with buyers who wait losing some of their negotiating power.

Another important factor is rising demand, both from at home and abroad.

CTV News goes on to say:

Given the building demand – both organic and from immigration – the 2025 spring market may start as early as late January or early February, a pull-ahead phenomenon we’ve seen in previous market turnarounds.

If history is any indication, housing activity will pick up in early 2025.

But what should homeowners who are thinking of selling right now do?

WOWA gives the following advice:

…for sellers, rising inventory can result in longer times on the market and potentially lower sale prices, necessitating more competitive pricing and additional incentives to attract buyers.

As interest rates fall, prices may rise, but if you’re thinking of selling now that requires pricing for today’s market and not for the future.

As for “additional incentives,” sellers should be flexible on setting a closing date, making minor upgrades or repairs, and compromising with buyers on certain issues.

September 2024 Market Report Conclusion

After months of decline, home sales are finally picking up.

While prices slid year-over-over, they gained month-over-month, along with sales and listings.

Home seekers currently enjoy the benefits of a deep buyer’s market, while sellers can look forward to increased competition thanks to interest rate cuts.

With another rate cut expected on October 23rd, the housing recovery will continue at an even faster pace.

Want to know more about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023