Overview: a look at the August 2024 GTA housing data, including sales, prices and listings, the impacts of three rate cuts on buyers and sellers, plus advice for navigating the current market.

After slashing interest rates on June 5th and July 24th, the Bank of Canada (BoC) did so again on September 4th.

The 25 basis point reduction marks the third consecutive cut, taking the central bank’s key policy rate from 4.50% to 4.25%.

But if the previous two rate cuts weren’t enough to entice buyers, will this one be any different?

Let’s find out by, starting with the latest numbers…

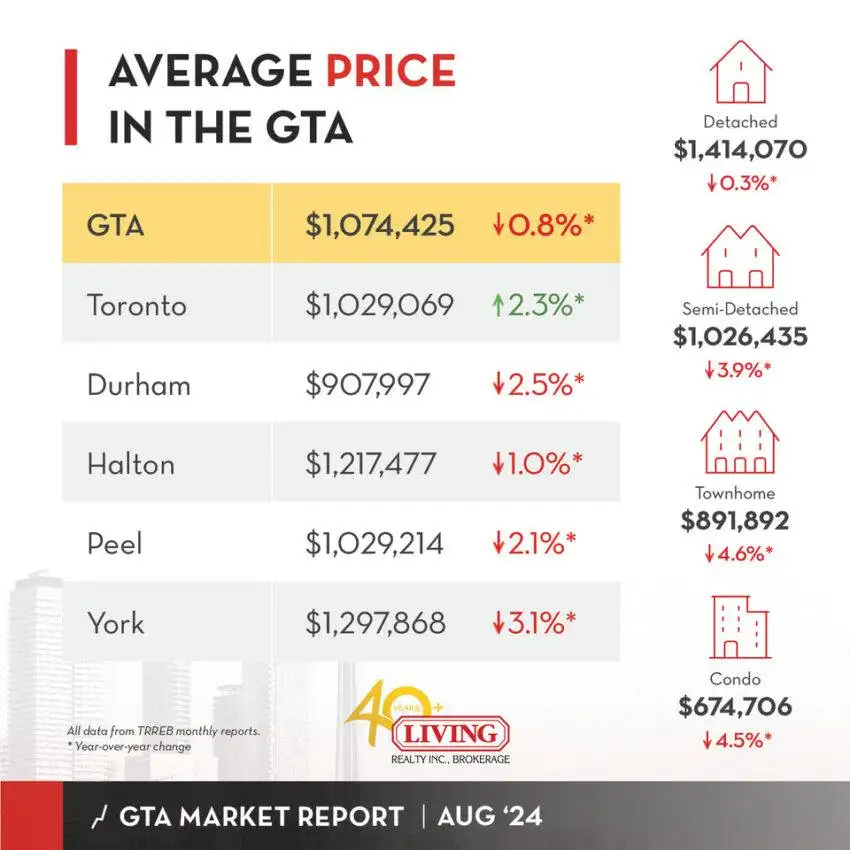

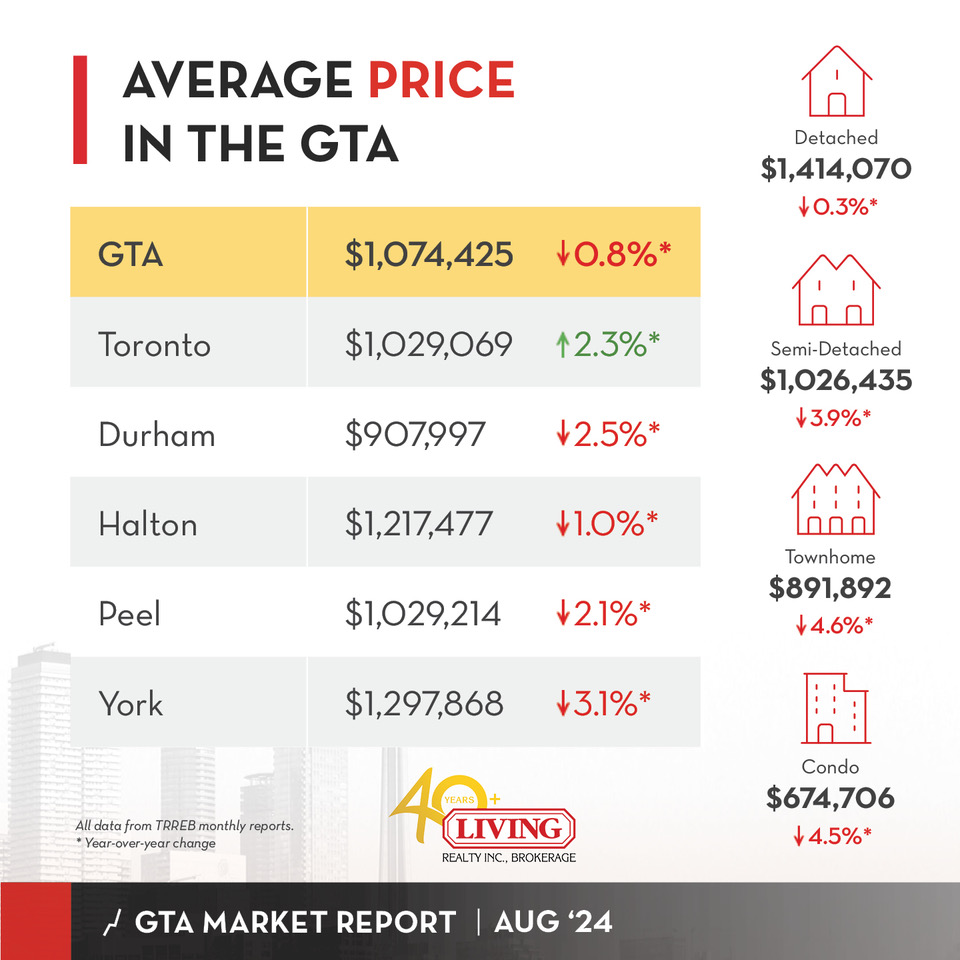

August 2024 GTA Housing Market Numbers

Here’s a year-over-over look at the August 2024 numbers:

- GTA Home Prices: down 0.8% to $1,074,425

- Toronto Home Prices: up 2.3% to $1,029,069

- GTA Home Sales: down 5.3% to 4,975

- Toronto Home Sales: down 9.1% % to 1,718

- New Listings: up 1.5% to 12,547

- Active Listings: up 46.2% to 22,653

Sales and prices were both down across the GTA, while new listings edged up.

On the other hand, Active Listings (i.e. the total number of homes for sale, including from previous months) jumped 46.2%.

In short, supply far outweighed demand—a stark contrast to previous years.

Reuters explains the reason behind the trend:

Housing economists and real estate agents have predicted that home prices would gradually start to fall as new listings rise as some homeowners, burdened with high interest rates, seek an exit to avoid defaulting on mortgages.

So the decline in home sales and prices is due to homeowners listing their properties as high interest rates push them to the brink of default.

On a month-over-month basis, GTA home sales inched up 0.6%, while the average selling price dipped 0.8% from July.

What exactly did buyers purchase last month?

August 2024 Home Prices By Property Type

Here’s a year-over-over breakdown of prices by property type:

- Detached Houses: down 0.3% $1,414,070

- Semi-Detached Houses: down 3.9% to $1,026,435

- Townhouses: down 4.6% to $891,892

- Condos: down 4.5% to $674,706

Prices weren’t the only thing to drop.

When it comes to sales, Global News informs:

All property types saw fewer sales in August 2024 compared with a year ago throughout the GTA. Condos led the drop with 11.4 per cent fewer sales, followed by townhouses at 6.1 per cent and semi-detached homes at 3.4 per cent.

Condos were the biggest loser by far, with sales plunging 11.4% and prices sinking 4.5%.

Interestingly, the most expensive property also had the most sales.

Detached houses had a total of 2,218 sales compared to 427 for semi-detached homes, 872 for townhouses and 1,417 for condos.

In the GTA, detached home prices fell 0.3% as sales dropped 1%.

In Toronto, however, detached home prices actually rose 3.2% as sales jumped 8.2%, making detached houses the only property to experience sales and price growth in either region.

While there’s no clear answer as to why detached homes were so popular last month, the answer is most likely lower interest rates.

Interest Rates & The Housing Market

Two rate cuts did bring relief to homeowners—especially those with variable-rate mortgages (VRMs).

CBC News reports:

The impact of this Wednesday’s rate cut will be felt first by Canadians with variable rate mortgages…immediately.

In fact, soon after the BoC’s announcement all five of Canada’s big banks lowered their prime lending rates from 6.7% to 6.45%.

For every 25-basis point drop, homeowners with VRMs will see their monthly payments drop by about $15 per every $100,000 of mortgage.

That might not sound like much, but after three rate cuts (or 75 basis points), GTA homeowners stand to save $483.49 per month—or $5,801 per year!

But as we’ve seen, two rate reductions weren’t enough to reinvigorate the housing market, and that may not change even with the latest cut.

So what will bring buyers back?

Yahoo Finance has the answer:

…a “significant decrease” in borrowing costs is needed to revive housing activity.

What are the chances of that happening?

Money markets give a 93% chance of another rate cut in October and December, and it won’t stop there.

Desjardins expects six more rate cuts in 2025, which would bring the overnight rate to 2.25%.

So for buyers to return to the market, borrowing costs first need to come down significantly.

Based on expert forecasts, that will happen—but it may take some time.

Till then, what should buyers and sellers do?

Advice For Home Buyers

The Financial Post cautions:

On one hand, home values have largely plateaued this year and affordability has improved due to lower borrowing costs… However, once the backlog of sidelined buyers is released into the market, pent-up demand will drive prices higher.

Waiting for lower interest rates means facing more competition and paying higher prices.

Other reasons to act now is that there’s plenty of inventory and homes are taking longer to sell.

Not only do these increase the chances of finding your dream home, but you’ll face less competition and have more leverage during negotiations.

Although the GTA is currently in a buyer’s market, that may soon change…

WOWA informs:

The month’s sales-to-new-listings ratio (SNLR) rose to 39.7%, almost rising out of buyer’s market territory from 33% last month.

WOWA goes on to say that this upward movement indicates that demand is growing faster than supply, a problem that will get worse as rates come down.

If you do decide to buy, RBC offers the following advice:

So, if you believe you’re close to purchasing, locking in a rate can give you some peace of mind. If rates stay the same or go up, you keep the rate you’re locked in at. But if they go down, you could get access to a new lower rate.

Most lenders let you lock in a rate for 120 days—giving you four whole months to see if rates go even lower.

Advice For Home Sellers

The good news is that the GTA is almost in balanced market territory, which means buyers will no longer have the same leverage.

Furthermore, the cumulative effect of three rate cuts will pull more buyers into the market.

According to The Atlus Group:

While BoC interest rate decisions are rarely a catalyst for action in the short term, they are important signals for the broader market and indicate that the tides may be turning, even if a significant uptick in transaction activity doesn’t materialize immediately.

In other words: the effects of the rate cuts won’t be immediate, but will be felt over time.

So for now, sellers should exercise patience—especially those with condos.

The Toronto Regional Real Estate Board (TRREB) agrees:

As mortgage rates continue to trend lower this year and next, we should experience an uptick in first-time buying activity, including in the condo market.

And to attract those buyers, sellers should set a realistic price based on where the market is today, not where it was years ago.

Sellers can also offer incentives like paying for home inspections, picking a closing date that suits buyers, or throwing in free appliances.

Given their popularity last month, it’s also an opportune time to sell detached houses.

Just be sure to price them correctly.

August 2024 Market Report Conclusion

Even though buyers enjoyed several perks, including abundant supply, lack of competition, lower prices and cheaper mortgages, many chose not to take advantage of them.

Sellers, on the other hand, had a pretty rough month, with prices falling and properties staying on the market far longer.

But as the rate cuts start adding up, buyers will slowly return.

The result: sellers will see more competition and higher prices, while buyers will benefit from lower interest rates and mortgage payments.

Want to know more about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023