Overview: your ultimate guide to buying resale property in Toronto, including the steps you need to take, checklists of things to do, and answers to your most frequently asked questions.

What Is a Resale Property?

A resale property is a home that has already been bought and is being sold by its current owner.

In short, it’s not a new home but a previously owned one (like a used car).

Resale properties can include:

- Detached houses

- Semi-detached houses

- Townhouses

- Condominiums

- Duplexes

What Are The Advantages Of Buying A Resale Property?

There are several benefits to buying a resale property, including:

- Savings: not having to pay the 13% Harmonized Sales Tax charged on new homes

- Lower prices: resale homes are often cheaper than new homes

- Move-in ready: no need to wait for construction to be completed

- Established neighbourhoods: easier access to schools, parks, retail, transit, etc

- More living space: older homes tend to be bigger than new homes (especially condos)

- Flexible pricing: buyers have room to negotiate (unlike fixed pre-construction pricing)

What Are The Disadvantages Of Buying A Resale Property?

Downsides of buying a resale property may include:

- Repair costs: older homes may require renovations

- Outdated technology: older homes are often less energy efficient

- Fewer amenities: older condos tend to have less perks

- Competition: popular neighbourhoods can attract many buyers, driving up prices

Depending on their age and location, some resale properties are exempt from the above.

How To Buy Resale Property In Toronto

Here’s a simple step-by-step guide to buying resale property in Toronto and the GTA:

1. Research your preferred neighbourhoods

- Narrow down your choices to the top 3

- eg. the Financial District, Waterfront & Church-Yonge Corridor

- Doing so saves you the time and trouble of visiting multiple neighbourhoods later

2. Find a real estate agent who knows the area well

- A local agent can provide deep insights into the neighbourhood

- eg. proximity to schools, transit, parks, retail, dining, nightlife etc

- The agent will also act as your guide throughout the entire buying process

3. Get your finances in order

- This includes your credit history as well as tax, financial and employment documents

4. Find a lender

- A lender can be your own bank, or a credit union, mortgage company or private lender

- The goal should be to find a lender that combines great service and competitive pricing

5. Get pre-approved for a home loan

- Getting pre-approved shows how big a mortgage you can afford & your monthly payments

- The lender will also provide a pre-approval letter and help you prepare for escrow

6. Start looking for a home

- Discuss what you want in a property with your agent

- eg. house or condo, # of bedrooms, amenities etc

- Schedule home tours and make an itinerary

- Find out selling prices for similar homes in area

- Decide on your dream home

7. Make an offer

- Negotiate price based on based on agent’s comparative market analysis

- Review contract terms and set time limit for closing date

- Make a deposit within 24 hours of your offer being accepted

8. Perform a home inspection

- Identify and negotiate repairs

- Schedule visit after repairs are completed

- Request status certificate and title exam to verify ownership

- Ask for a list of what conveys with the property (eg. appliances)

9. Perform a pre-closing walk-through

- Confirm all necessary repairs are made

10. Finalize your finances

- Transfer funds for closing

- Notify your lender of being under contract

- Provide all requested documents ASAP

11. Get ready to move

- Setup utilities

- Get home insurance

- Reserve a moving company

- Update your address with necessary institutions (eg. CRA and Service Ontario)

12. Review and close on your new home

- Review closing statement

- Sign closing documents

- Contact lender to wire down payment

- Bring printed confirmation of wire transfer

- Get your keys!

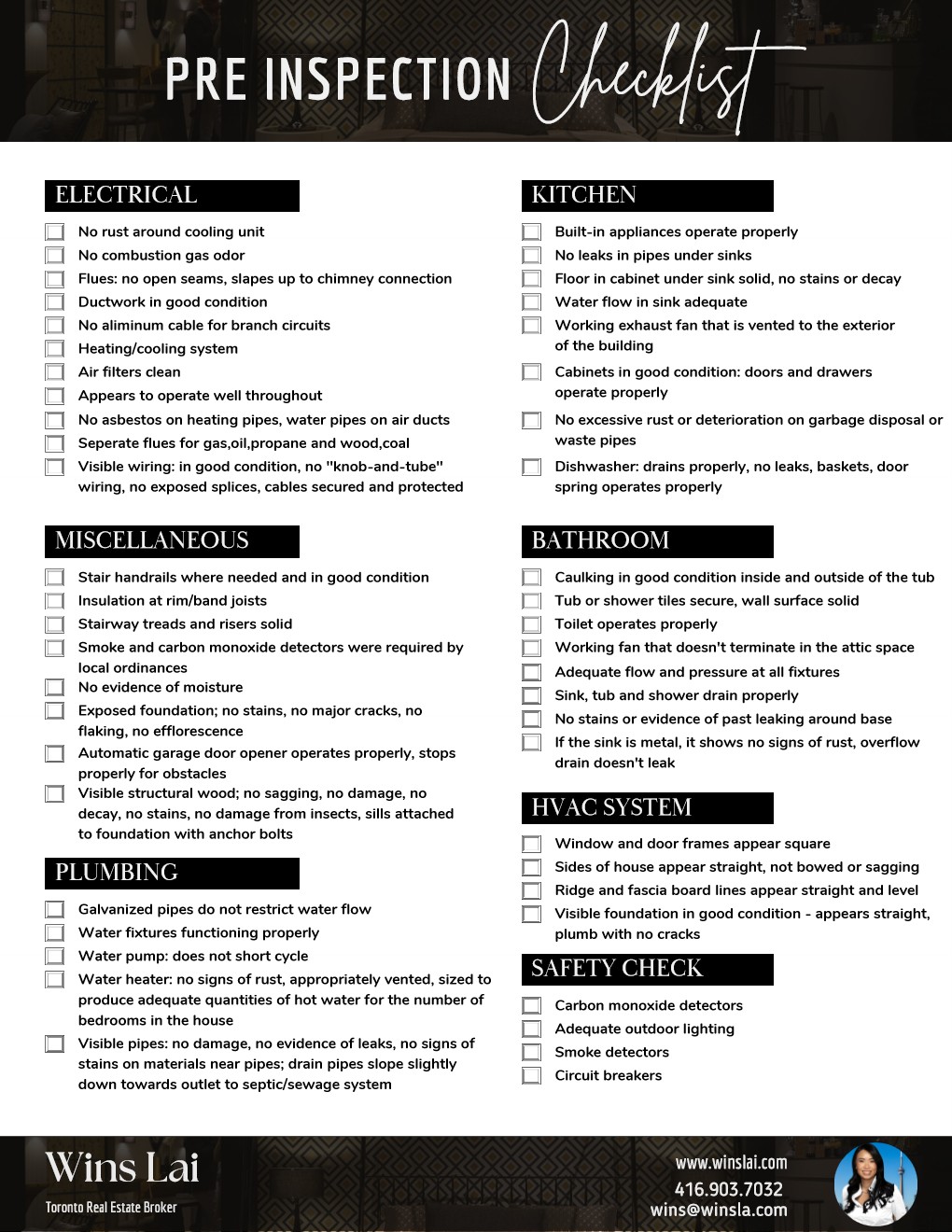

Pre-Inspection Checklist For Resale Properties

Here is a list of things you should examine before buying resale property:

Electrical

- No rust around cooling unit

- No combustion gas odor

- Proper flue connections without open seams

- Ductwork in good condition

- No aluminum cable for branch circuits

- Functioning heating/cooling system

- Clean air filters

- No asbestos in heating or water pipes

- Separate flues for different fuel types

- Visible wiring in good condition

Plumbing

- Working water fixtures

- Unrestricted water flow in galvanized pipes

- Water pump does not short-cycle

- Piping is free of leaks and stains

- Piping drains correctly to septic/sewage system

- Water heater properly vented, rust-free and has sufficient hot water capacity

HVAC

- Air conditioner and heater in working order

- Proper air flow in vents

- Vent covers aren’t cracked or broken

Kitchen

- Sink has good water flow

- Built-in appliances function properly

- Piping under sink is leak-free

- Dishwasher drains with no leaks

- Cabinets and drawers are in good condition

- Under-sink cabinet floors are free of stains and damage

- Exhaust fan operates correctly and vents outside

- Garbage disposal and waste pipes are free of excessive rust/deterioration

Bathrooms

- Shower tiles are secure

- Caulking around tub/shower is intact

- Toilet and water fixtures function correctly

- Water flow and pressure is optimal

- Exhaust fan doesn’t vent into the attic

- Proper drainage in sink, tub and shower

- No stains or leaks around the tub or toilet base

- Metal sinks are rust-free with functioning overflow drain

Exterior

- Door and window frames appear square

- Exterior walls look straight with no bowing or sagging

- Roofline and fascia boards are level

- Foundation in good condition with no cracks

Safety Check

- Adequate outdoor lighting

- Circuit breakers in proper working order

- Smoke and carbon monoxide detectors proven to work

Miscellaneous

- Stairs have sturdy handrails

- Solid stair treads and risers

- No signs of moisture

- Proper insulation in rim/band joists

- Garage door opener functions properly

- Foundation in good condition with no stains, cracks or flaking

- Brick and concrete surfaces are free of efflorescence (ie. white, powdery stains)

- Structural wood is secure with no sagging, decay or insect damage

Tips For Buying Resale Property

- Visit neighbourhoods at different times to identify noise levels, traffic, safety issues etc

- Take notes and pictures of the neighbourhood for comparison

- Review condo bylaws, maintenance fees and reserve fund requirements

- Consult a real estate lawyer to help with due diligence, title searches, paperwork etc

- Look out for hidden costs (older homes may need to be brought up to code)

- Consider the property’s future resale value (eg. is the property located in a growing area)

Buying Resale Property: Frequently Asked Questions (FAQs)

What is a resale property?

A resale property is a house or condo that has been previously owned and is being sold again on the open market.

Resale properties are different than newly built or pre-construction homes, which is sold directly by the builder.

Is it better to buy a resale property or pre-construction homes in Toronto?

It depends on your needs, goals and finances. Resale homes are typically cheaper newly built homes.

They’re also move-in ready, while pre-construction homes may take years to be ready.

Furthermore, buyers don’t have to pay the 13% HST (Harmonized Sales Tax) on resale homes, saving them thousands.

Since the average price of a home in Toronto is currently $1,107,463, a 13% HST means buyers would pay an extra $143,970 for a total of $1,251,433!

What should I check for before buying a resale property?

Look for the following:

- The title deed (proves ownership)

- Outstanding dues (e.g. unpaid property taxes)

- Status certificate (required when buying resale condos)

- Zoning and land use (confirm property complies with local zoning laws)

- Encumbrances and liens (shows if property has any financial claims against it)

How do I make sure I don’t overpay when buying resale property?

Here are some tips:

- Factor in seller urgency

- Ask your agent to put together a property comp

- Research prices for similar properties in the area

- Negotiate based on the property’s age, physical condition, and cost of any necessary repairs

- Look at current market trends for the property type (eg. lower condo prices due to cooling demand)

Do I have to pay a Land Transfer Tax when buying resale property?

Yes, buyers must pay a Land Transfer Tax on resale homes.

The amount depends on the property price and is calculated as follows:

- 0.5% on first $55,000

- 1.0% on portion from $55,001 to $250,000

- 1.5% on portion from $250,001 to $400,000

- 2.0% on portion from $400,001 to $2,000,000

- 2.5% on properties over $2,000,000

In addition to the provincial land transfer tax, buyers in Toronto have to pay a Municipal Land Transfer Tax (MLTT), which follows the same structure outlined above.

There’s also a luxury land transfer tax for high-value properties.

How big a deposit am I required to pay for a resale home in Toronto?

The deposit for a resale property is usually 5% of the purchase price, payable within 24 hours of accepting an offer.

Can I claim a First-Time Home Buyer Incentive (FTBI) for resale properties?

Yes, resale homes qualify for the FTBI, as long as you meet the criteria.

Why should I hire a real estate agent when buying resale property?

A good real estate agent acts as your guide, offering advice, identifying opportunities, and negotiating on your behalf.

Here are just some of the things an agent can do for you:

- Handle scheduling, showings, and documentation

- Offer guidance on renting, refinancing and renovations

- Spot potential red flags in properties and save you expensive repairs

- Connect you with real estate lawyers, inspectors and mortgage brokers

- Provide property comps (ie. a comparison of prices for similar properties in the neighbourhood)

Conclusion: The Perks Of Buying Resale Property

That’s certainly true of resale properties, which are often cheaper than newly built homes, located in already established neighbourhoods, move-in ready, and free from the 13% HST.

But not all resale properties are created the same.

Some may have defects that the average buyer can’t spot, or carry certain legal or financial risks.

That’s why it’s important to have a trusted real estate professional on your side, giving you advice, doing market research, communicating with you constantly, and negotiating on your behalf.

I specialize in resale properties, including houses and condos, and can help you find your dream home.

If you’re looking to buy a resale property in Toronto or the GTA, simply contact me below.

Wins Lai

Real Estate Broker

Re/Max Ultimate Realty Inc., Brokerage

m: 416.903.7032 p: 416-530-1080

f: 416-530-4733

a: 836 Dundas St W Toronto, ON M6J 1V5

w: www.winslai.com e: wins@winslai.com