Overview: examining the impacts of the Bank of Canada’s interest rate cut on the June 2024 GTA housing market, including sales, prices and inventory, plus advice for buyers and sellers.

Toronto home sales fall in June despite rate cut

Toronto Real Estate Sees Fewest Sales In Decades

“On Hold”: June Rate Cut Fails To Revive Toronto’s Housing Market

But as the headlines above show, that clearly didn’t happen.

Instead of frenzied buying and selling activity, June 2024 saw a decrease in home prices and the lowest number of sales in over a decade.

So what went wrong?

Let’s start by looking at last month’s housing numbers.

June 2024 GTA Housing Market Numbers

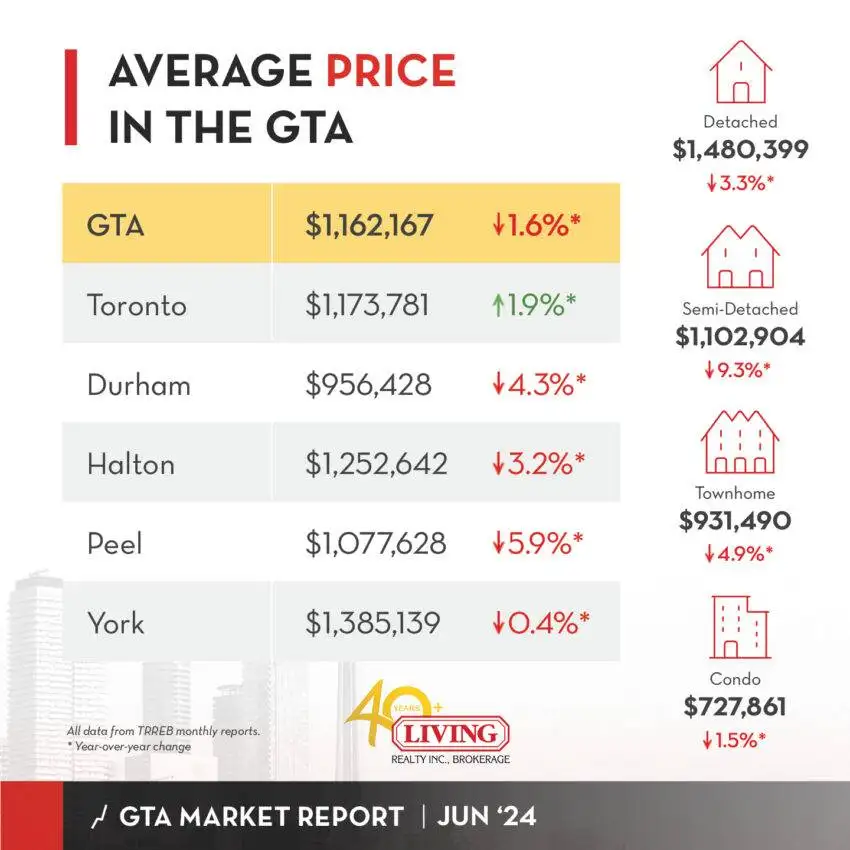

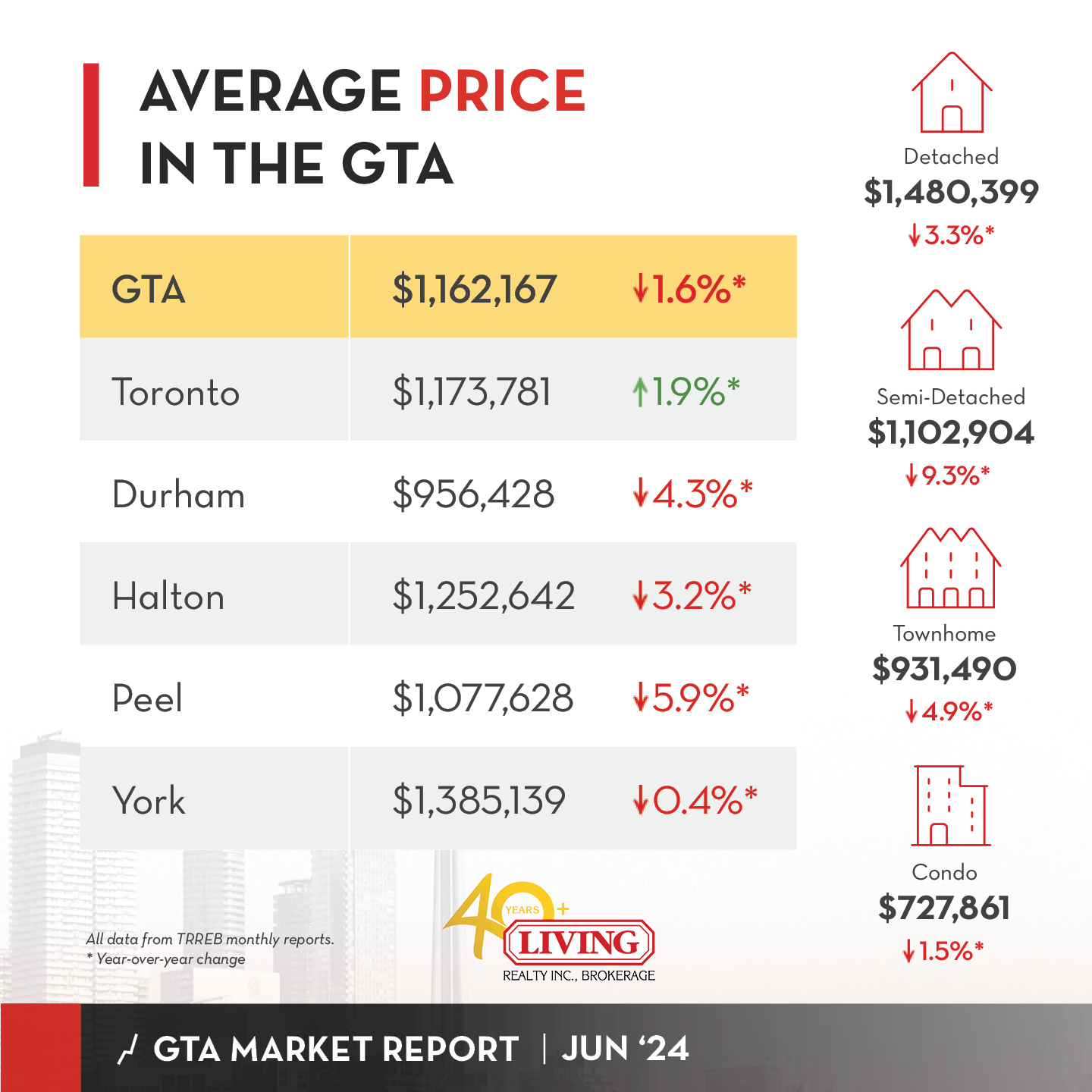

Here’s a year-over-over look at the June 2024 numbers:

- GTA Home Prices: down 1.6% to $1,162,167

- Toronto Home Prices: up 1.9% to $1,173,781

- GTA Home Sales: down 16.4% to 6,213

- Toronto Home Sales: down 21.1% to 2,236

- New Listings: up 12.3% to 17,964

- Active Listings: up 67.4% to 23,613

If interest rate cuts were supposed to re-energize the housing market, why did sales drop by 16.4%?

The Toronto Regional Real Estate Board (TRREB) offers an explanation:

Despite the Bank of Canada rate cut at the beginning of last month, many buyers kept their home purchase decisions on hold. The market remained well-supplied, resulting in a slight dip in the average selling price compared to June 2023.

One rate cut wasn’t enough to bring back most buyers, with many choosing to wait for interest rates to fall further.

The number of Active Listings also jumped 67.4% to a 14-year high, and as supply exceeded demand, GTA home prices dipped 1.6%.

The rate cut didn’t have much of an impact on the year-over-over numbers, but what about month-over-month?

On a monthly basis, GTA home prices actually fell 0.3%, while sales plummeted 11.4%.

Furthermore, the Sales-To-New-Listings Ratio (SNLR) went from 38% to 35%, firmly placing the GTA in a buyer’s market.

So despite the reprieve of a rate cut, home prices and sales are on the decline throughout the GTA.

June 2024 Home Prices By Property Type

Here’s a year-over-over look at prices by property type for June 2024:

- Detached Houses: down 3.3% to $1,480,399

- Semi-Detached Houses: down 9.3% to $1,102,904

- Townhouses: down 4.9% to $931,490

- Condos: down 1.5% to $727,861

Semi-detached homes were the worst performers, with prices dropping 9.3%, followed by townhouses at 4.9%, detached houses at 3.3%, and condos at 1.5%.

When it comes to sales, the GTA saw:

…condo apartments falling by 25.9%, townhouses dropping by 14.3%, semi-detached homes decreasing by 4.0%, and detached homes seeing an 11.7% decline in the month of June.

Once again, condos were the worst sales performers last month.

According to the Financial Post:

Condo market woes showed no signs of abating in June, with sales plummeting by 28 per cent compared to last year. This, despite condos typically being the entry-level choice for first-time homebuyers and investors.

In fact, GTA condo demand has become so weak that frustrated sellers are cancelling listings at record levels.

So why didn’t June’s interest rate cut lead to higher sales and price growth?

Interest Rates: Impact & Forecast

Many experts predicted housing demand would pick up.

But as TRREB informs, that didn’t happen:

The Bank of Canada’s rate cut last month provided some initial relief for homeowners and home buyers. However, the June sales result suggests that most home buyers will require multiple rate cuts before they move off the sidelines.

While the rate cut did provide some relief (e.g. to homeowners with variable rate mortgages), it did little to spur demand.

It turns out 25 basis points wasn’t enough to bring back buyers.

So what would it take for buyers to step off the sidelines and into the housing market?

A June 2024 Ipsos poll finds that interest rates would have to come down 100 basis points or more to boost home sales.

What are the chances of that happening?

According to Nesto.ca, pretty good:

The Big 6 Banks all agree in their predictions that we may see rates come down this year by as much as 75 to 100 basis points.

With Canada’s jobless rate recently hitting a 29-month high, the chances of another rate cut on July 24th is now 56%.

However, it may take till next year before interest rates come down a full 100 basis points.

What should buyers and sellers do in the meantime?

Advice For Home Buyers

WOWA confirms:

The month’s sales-to-new-listings ratio (SNLR) dipped to 35%, down into buyer’s market territory… This downward movement indicates that demand is growing slower than the supply of available homes for sale, slightly tipping the balance in favour of buyers.

At 35%, the GTA is well into buyer’s market territory, and as supply grows and demand slows, buyers benefit from more choice, less competition, and lower prices.

But supply isn’t just growing—it’s skyrocketing.

Active listings shot up 67.4% to 23,613 in June 2024, while sales fell 16.4% to 6,213.

That means 73.7% of homes on the market failed to sell.

In other words: buyers currently have a lot of choice and very little competition—making now the time to buy.

Buyers also enjoy lower prices on all property prices, giving them more freedom to find their dream home for a lot less.

For example, detached home prices have fallen by $316,804 from their February 2022 peak, while semi-detached homes are down by $255,511, townhouses by $190,151, and condos by $72,105.

To top it all off, interest rates are finally dropping, making mortgages more affordable.

While waiting for interest rates to fall even more is an option, the downside is that other buyers will have entered the market by then, leading to greater competition and higher prices.

Advice For Home Sellers

As interest rates drop, more and more buyers will enter the housing market.

The fact is Canada’s population is growing at a record pace, and with it, the need for housing.

TRREB agrees:

Despite a temporary dip in home sales due to high interest rates, we know that strong population growth is driving long-term demand for ownership and rental housing.

All those people will need a place to stay, which means there are plenty of potential buyers out there.

And just because home prices fell in June 2024, that doesn’t mean you have to sell at a discount.

As WOWA informs:

The City of Toronto is still seeing a year-over-year increase in its average home price, a rare case amid a sea of red across the Greater Toronto Area.

Last month saw Toronto home prices rise 1.9%, and the second-highest selling price ever for the month of June.

While condo owners may have some trouble offloading their properties, detached homeowners won’t have any problems.

Of the 6,213 homes sold in June, detached houses accounted for 2,988 or 43%!

That’s far ahead of condos, the cheapest property, which had 1,520 sales, townhouses with 1,054 sales, and semi-detached homes with 599 sales.

So detached home sellers are well-positioned to take advantage of the current demand for their properties.

June 2024 Market Report Conclusion

But as interest rates continue to fall, sales, competition and prices will increase—just as they did during COVID.

While GTA buyers enjoyed abundant inventory, lacklustre competition and lower prices, Toronto home sellers saw prices rise in June.

Historic immigration will further add to housing demand, while buyers will benefit from more affordable mortgages.

Speaking of which, the chances of another rate cut on July 24th are pretty high—which could make for a more active August.

Want to know more about the housing market? Contact me below for answers.

Wins Lai

Real Estate Broker

Living Realty Inc., Brokerage

m: 416.903.7032 p: 416.975.9889

f: 416.975.0220

a: 7 Hayden Street Toronto, M4Y 2P2

w: www.winslai.com e: wins@winslai.com

*Top Producer (Yonge and Bloor Branch) — 2017-2023